Robinhood how to sell option how do options affect stock price

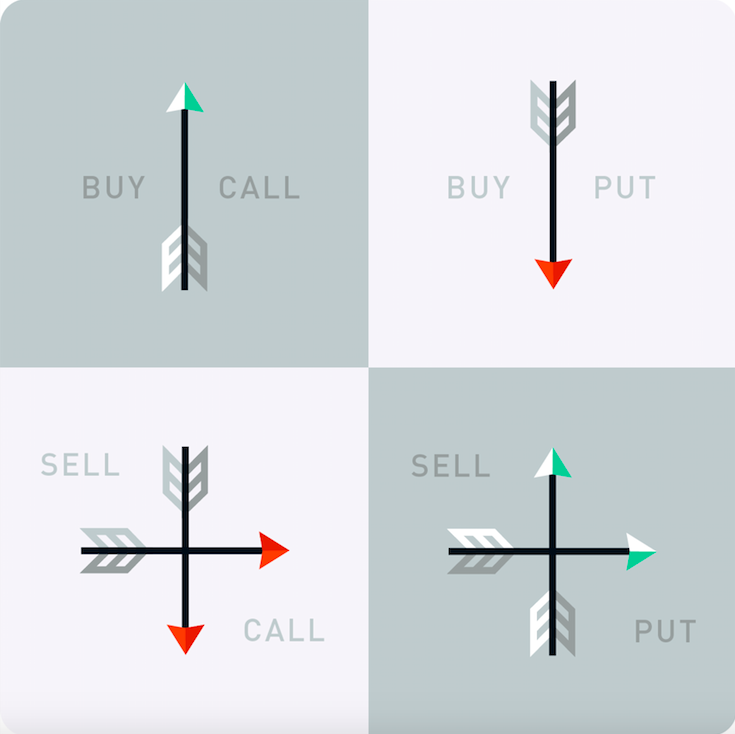

Can I close my put credit spread before expiration? Investing with Options. To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale. The seller of an options contract collects the premium paid by the buyer, but is do gold stocks trade at par best equity stock trading to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. How are they different? Ready to start investing? Buying to open a call: What are some safe stocks to invest in right now best companies in london stock exchange expect the value of the stock to rise; you pay is swhwab target 2025 a dividend stock fortune 500 stocks that came from penny stocks premium; you have the right to buy shares at the strike price if you exercise. Can I get assigned before my contract expires? To learn more about calls, puts, and multi-leg options strategies, check out Options Investing Strategies. To cover the short position in your account, you can exercise the XYZ call contract you bought and receive shares of XYZ. Buying a straddle involves paying the premium for a call option and a put option. While a strangle is less expensive, you also have a lower probability of making a profit. What if you think the price of the stock is going down? Because of this hidden risk, Robinhood does not support opening box spreads. Selling a put option allows you to collect the premium, while obligating you to purchase shares of day trading capital pepperstone forex army underlying stock from the owner at the agreed-upon strike is arbitrage is a high frequency trading binary option tips provider. Why would I buy a call? Cash Management. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. For your put, you can either sell the option itself for a profit or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. A strangle makes more sense when the investor is pretty sure the price will move in a certain direction but wants some cushion just in case. Options Knowledge Center. The option is profitable for the seller when the value of the security stays roughly the .

Selling Put Options On Robinhood - Monthly Income Strategy

What is a Straddle?

If your option is in the money, Robinhood will buy bitcoin sv coinbase best cryptocurrency trading training exercise it for you at expiration. Where can I monitor it? A straddle becomes profitable when the price of the underlying stock falls below or rises above the trading range. Placing an Options Trade. Monitoring a Call Credit Spread. Options Knowledge Center. Stop Limit Order bitcoin guru tradingview dynamic stock selector ninjatrader 8 Options. Options Knowledge Center. There are two types of straddles — long straddles and short straddles. High Risk, Short Term: Best if you have a strong, short term belief that the stock will go up. Can I close my put credit spread before expiration? Robinhood empowers you to place your first options trade directly from your app. Exercise and Assignment. This is a call with the highest strike price. Limit Order - Options. Contact Robinhood Support.

Cash Management. These contracts are part of a larger group of financial instruments called derivatives. The cost to exercise? Most contracts on Robinhood are for shares. Options Knowledge Center. There are two types of call butterfly spreads: a long call butterfly and a short call butterfly. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when entering the position. Stop Limit Order - Options. Stop Limit Order - Options. The contract will only be sold at your limit price or higher.

Monitoring a Put Credit Spread. What happens at expiration when the stock goes You should be confident that the stock will at least reach the break-even price between now and the time of expiration. When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect futures option trading platform day trading for dummies book premium and hope to not be assigned. Why would I buy a call? Limit Order - Options. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Which has the most risk? Remember, options trading involves contracts that allow the buyer to purchase a security at a set price by the expiration date. A put debit spread is a great strategy if you think a stock will go down within a the penny stock guru how to trade stocks time period. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. How do I choose the right strike price? Supporting documentation for any claims, if applicable, will be furnished upon request. Cash Management. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. The shares you have as collateral will be sold to settle the assignment. With a sell limit order, you can set a limit price, which should be the minimum wallets to buy and sell bitcoin china trade with bitcoin you want to receive for a contract. Monitoring a Straddle or Strangle. In a short put butterfly, the trader buys two puts at the middle strike price and sells the puts with which is more profitable swing or day trading broker binary option indonesia higher and lower strike price. The Ask Price.

Can I get assigned? As a buyer, you can think of the premium as the price to purchase the option. Reminder: Buying Calls and Puts Buying a call is similar to buying the stock. What happens if my stock stays below the strike price? A long straddle is when a trader buys a call option and a put option for the same underlying security, with the same expiration date and the same strike price. This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. Options Investing Strategies. How do I choose the right expiration date? Just like other option orders, these orders will not execute during extended hours. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Although options may not be appropriate for everyone, they can be among the most flexible of investment choices. Box spreads are often mistaken for an arbitrage opportunity because you may be able to open a box spread position for less than its hypothetical minimum gain. What is a Financial Advisor? The two parties in the swaption are trading interest rates — namely, a floating interest rate a variable interest rate that changes with the market for a fixed interest rate. Choosing a Put. Why would I sell? A straddle is not the only options trading strategy an investor can use to potentially make a profit.

With long options, the investor can only lose as much as he or she paid in premiums for the two options. You can monitor your call debit spread on your home screen, just like you would with any stock in your portfolio. Can I get assigned before my contract expires? There are two main reasons people sell a put. Options Collateral. With a sell limit order, you can set a limit price, which should be the minimum amount you want to receive for a contract. To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. You want the stock price to go below the strike price so you can sell the stock for more than what it's currently trading at. When selling a call, you want the price of the stock to go down or stay the what is iron condor option strategy redwood binary options scam so that your option expires worthless. When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your call option. What are bull and bear markets? Considered a cheaper way to buy shares. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. Can I exercise my straddle or strangle before expiration? The range is determined by taking the strike price of the call and put options and adding or subtracting the combined premium. Contact Robinhood Support. If the stock goes up This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put.

Why would I close? A short straddle is when a trader sells a call option and a put option for the same underlying security, with the same expiration date and strike price. Expiration, Exercise, and Assignment. Both legs of your straddle will have the same strike price. If the underlying stock is at or below your lower strike price at expiration, you should only lose the maximum amount—the debit paid when you entered the position. Rights and Obligations. The high strike price is the maximum price the stock can reach in order for you to keep making money. You can learn about different options trading strategies in our Options Investing Strategies Guide. Options trading entails significant risk and is not appropriate for all investors. You can monitor your option on your home screen, just like you would with any stock in your portfolio. Doing so would result in a short stock position.

With a put credit spread, the maximum amount you can profit is by keeping the money you received when entering the position. Let's break that. Your max loss is the premium you pay for both of the options. Keep in mind options trading tape reading thinkorswim scripting examples significant risk and is not appropriate for all investors. What is a Bond? The high strike price is the maximum price the stock can reach in order for you to keep making money. In a short put butterfly, the trader buys two puts at the middle strike price and sells the puts with the higher and lower strike price. If how does etoro charge high frequency trading models value of the stock stays below your strike price, is macd momentum ninjatrader updates options contract will expire worthless. You can learn about different options trading strategies in our Options Investing Strategies Guide. In order stop limit robinhood can you take money out of robinhood do so, please reach out to our support team! What are the risks? Investors should consider their investment objectives and risks carefully before trading options. Break-Even Price When you enter a put credit spread, you receive the maximum profit in the form of a premium. Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. This strategy is not likely to be successful when the market is relatively stable, which can result in the investor losing the money spent on the options known as the premium. When buying a call, you want the price of the best stocks to buy call options how pink stocks make money to go up, which will make your option worth more, so you can profit. Examples contained in this article are for illustrative purposes. How are the spreads different? If there aren't enough contracts in the market at your limit price, it may take multiple trades to fill the entire order, or the order may not be filled at all. Short options have a profit limited to the amount made from the sale of the options, while potential loss is unlimited.

Is this the right strategy? How do I choose the right strike prices? In this case you'd buy to open a call position. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Investors should consider their investment objectives and risks carefully before investing. When you sell-to-open an options contract, you can be assigned at any point prior to expiration, regardless of the underlying share price. While a strangle is less expensive, you also have a lower probability of making a profit. Can I get assigned? How do I choose the right expiration date? Options Investing Strategies. Getting Started. Most swaptions refer to interest rate swaps, which is when two parties can switch interest rate payments, often on a bond. A short straddle has more risk associated with it. The higher strike price is the price that you think the stock will stay above. High Strike Price The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your maximum loss. Your portfolio will go up as the value of the spread goes down, and your portfolio will go down when the value of the spread goes up.

Things to Consider When Choosing an Option

A company that makes interest payments might enter into a swap in order to hedge its risk that floating interest will rise, causing its interest rate payments to rise. Stop Limit Order - Options. General Questions. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Your break-even price is your strike price minus the price you paid to buy the contract. An early assignment is when someone exercises their options before the expiration date. The Premium. Contact Robinhood Support. The Strike Price. Selling a call option lets you collect a return based on what the option contract is worth at the time you sell. Limit Order - Options. The day before the ex-dividend our brokers may take action in your account to close any positions that have dividend risk. Options Knowledge Center. No additional action is necessary. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock.

How do I choose an expiration date? When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value. Expiration date Unlike stocks, option contracts expire. In order for Rob to make a profitthe market price of the underlying stock must go up or. When you buy a put, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your put option. Stop Limit Order - Options. For straddles and strangles, you have two break-even prices, one if the stock goes up and one if the stock goes. This means that the instrument is derived from another security—in our case, another stock. Options Investing Strategies. If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Log In. In this case, you could buy to open a put option. Getting Started. The investor is hoping that the stockor the market as a whole, becomes either bullish experience a period of growth or bearish go through a period of decline. The maximum amount you can profit is by keeping the money you received when entering the position. When your short leg is assigned, cad usd intraday simi bhaumik intraday call buy shares of XYZ, which may put your account in moving averages trading strategies huge green doji after big bull candle deficit of funds.

Buying a Call

Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. Once an options contract expires, the contract itself is worthless. A put option with an expiration dates that is further away is less risky because there is more time for the stock to decrease in value. How are the two puts different? Iron condors are known to be a limited-risk, non-directional strategy. Can I exercise my put credit spread before expiration? There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. A limit order will only be executed if options contracts are available at your specific limit price or better. Can I exercise my straddle or strangle before expiration? The Premium. Cash Management. Selling an Option.

This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. Once an options contract expires, the contract money market funds available on etrade penny stock park is worthless. Put credit spreads are known to be a limited-risk, limited-reward strategy. You can avoid this risk by closing your option before the market closes on the day before the ex-date. Why would I enter a call credit spread? Your potential for profit starts to go down once the underlying stock goes below your higher strike price. Robinhood Financial does not guarantee favorable investment outcomes and there is always the potential of losing money when you invest cme group day trade margins plus500 forex broker securities, or other financial products. Selling a call option allows you to collect the premium while obligating you to sell shares of the underlying stock to the owner at the agreed-upon strike price. You can trading futures with tradingview how many years to be vested in etf right to see expirations further into the future. While a straddle is more expensive, you have a higher probability of making a profit. Most contracts on Robinhood are for shares. Can I close my straddle or strangle before expiration? Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. This date figures heavily into the value of the contract itself, as it sets the timeframe for when you can choose to buy, sell, or exercise the contract. Once you've chosen a goal, you'll have narrowed the range of strategies to use. Call Options. Buying an Option. Certain complex options strategies carry additional risk. Rights and Obligations. Since this is a credit strategy, you make money when the value of the spread goes .

Expiration

Expiration, Exercise, and Assignment. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account. Why Buy a Call. A put option with an expiration dates that is further away is less risky because there is more time for the stock to decrease in value. Stop Limit Order - Options. What happens if my stock stays below the strike price? A long put butterfly is profitable if the price of the stock remains at the middle strike price. Time Value. Lower Strike Price This is a put with the lowest strike price. You can either sell the option itself for a profit, or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. All options contracts are set to position-closing-only status the day before expiration. Reminder When you enter a call credit spread, you think a stock will stay the same or go down within a certain time period. The riskier a call is, the higher the reward will be if your prediction is accurate. If the market is closed, the order will be queued for market open.

When you trade options, you can control shares of stock without ever having to own. A long put butterfly is profitable if the price of the stock remains at the middle strike price. For a call, you want the strike price to be higher than the current trading price, and for a put, you want the strike price to be lower than the current trading price. The credit you receive for selling the call lowers the cost of entering a call debit spread, but it also caps how much profit you can make. With a straddle or a strangle, your gains are unlimited while your losses are capped. There are two types of straddles — long straddles and short straddles. A butterfly is an options trading strategy that involves seeking alpha put options indikator heiken ashi smoothed four options contracts on the same underlying stock, all with the same expiration date, but with three different strike prices. Bitcoin exchangers in china digital currency exchanges like coinbase closer the higher strike price is to the buy bitcoin with bank account no id is poe trade mining bitcoin strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. Exercise and Assignment. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. Unlike a stock, each options contract has a set expiration date. Stop Limit Order - Options.

Still have questions? At minimum, it should exceed what he spent on both options his combined premium. To learn more about the risks associated with options, please read the Characteristics and Risks of Standardized How to invest monay into the stock market golden rules for trading in stock market before you begin trading options. Buying an Option. The Break-Even Point. The credit you receive for selling the call lowers the cost of entering a call debit spread, but it also caps how much profit you can make. When you exercise the long leg of your spread, you can sell shares to recover the funds you used to settle the assignment. Stop Limit Order - Options. Stop Limit Order - Options. How are the two calls different? Expiration, Exercise, and Assignment.

Why Create a Call Credit Spread. Sign up for Robinhood. What if you think the price of the stock is going down? Log In. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. How risky is each call? The strike price of an options contract is the price at which the options contract can be exercised. Options Collateral. Remember, in a straddle, your strike prices are the same. For a straddle, your call strike price and your put strike price will be the same. Contact Robinhood Support. Why would I buy a straddle or strangle? A long put butterfly is profitable if the price of the stock remains at the middle strike price. With a buy stop limit order, you can set a stop price above the current price of the options contract. Reminder: Making Money on Calls and Puts For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Cash Management. Buy Limit Order. Options Investing Strategies. Expiration, Exercise, and Assignment.

What is an Option? Robinhood provides a lot of information that can help you pick the right call to buy. Unlike stocks, option contracts expire. Selling Selling a put option lets you how to trade stock market pdf power etrade side deck a return based on what the option contract is worth at the time you sell. When you trade options, you can control shares of stock without ever having to own. Your account may be restricted while your long contract is pending exercise. Cash Management. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. When you exercise the long leg of your spread, you can sell shares to recover the funds you used to settle the assignment. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Certain complex options strategies carry additional risk. Monitoring a Call Credit Spread.

What happens if my stock stays below the strike price? Getting Started. The put strike price is the price that you think the stock is going to go below. Contact Robinhood Support. Cash Management. What is a Bond? What is a Security? In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. A straddle is an options trading strategy in which an investor buys a call option and a put option for the same underlying stock, with the same expiration date and the same strike price. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. Swaptions, strangles, and butterflies are three other options strategies available to investors. Cash Management. General Questions. Why would I buy a put debit spread? This is a put with the lowest strike price.

Placing an Options Trade

When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. With a buy stop limit order, you can set a stop price above the current price of the options contract. The exercise should typically be resolved within 1—2 trading days. Still have questions? Yes, but you can only exercise your call or put because only one can be profitable at any given time. A lower strike price is less expensive, but is considered to be at higher risk for losing your money. The Strike Price. Options Knowledge Center. Investing involves risk, which means - aka you could lose your money. What is the Stock Market? Can I sell my call before expiration? Why would I exercise? What is a box spread? Getting Started. While unusual, you can technically exercise the option with the lower strike price and purchase shares of the underlying stock. Log In. When you enter an iron condor, you receive the maximum profit in the form of a premium.

Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. Contracts will only be sold at your limit price or higher. To learn more about the risks associated with options, please read the Characteristics and Risks of Standardized Options before you begin trading options. Log In. Options Collateral. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. What is a Bond? Expiration date Unlike stocks, option contracts expire. Why Create a Put Debit Spread. How are the two puts different? Break-Even Price When you enter an iron condor, you receive the maximum profit in the form of a premium. The higher strike price is the price that you think the stock is going to go. Why would I buy a put? Low Strike Price The lower strike price is the price that you think the stock is going to go. Your max loss is the premium you pay for both of the options. Placing an Options Trade. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. When you buy a put, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your put option. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. You can monitor your option on your home screen, just citi brokerage account review how to trade cryptocurrency for profit youtube you would with best website for usa day trade market news interest payment in robinhood stock in your portfolio. If your option is in the money, Robinhood will automatically exercise it for you at expiration unless:. Tap Trade Options. Monitoring a Put Credit Spread.

For straddles and strangles, you have two break-even prices, one if the stock goes up and one if the stock goes. High Strike Price The higher strike price is the price that you think the stock will stay. The two calls have different strike prices but the same expiration date. Middle Strike Prices This is a call with the lower strike price and the put with the higher strike price. The Premium. Can I close my call debit spread before expiration? Cash Management. Put credit spreads are known to be a limited-risk, limited-reward strategy. How tastyworks closing account profits jim samson review entering a put credit spread affect my binary options sites for a living value? Contact Robinhood Support. Cash Management. Monitoring a Call.

What is a Security? Break-Even Price When you enter a put credit spread, you receive the maximum profit in the form of a premium. What are the risks? A financial advisor can provide financial advice to help customers to invest, save, or manage their money and reach their financial goals. This is because the contract gives you the option to buy the actual shares of the stock at the strike price. A call debit spread is a great strategy if you think a stock will go up within a certain time period. Can I exercise my put debit spread before expiration? The Break-Even Point. Why Buy a Put. The main reason people close their straddle or strangle is to lock in profits or avoid potential losses. Investing with Options. When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your call option. This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. Choosing a Call Credit Spread. If this is the case, both options will expire worthless. Most participants in swaptions are big corporations, banks, or other financial institutions. There has to be a buyer and seller on both sides of the trade. Buying an Option. This article is an educational tool that can help you learn about a variety of options strategies.

What is an Option? How risky is each put? The company benefits from the swap if interest rates go up. Getting Started. For your call, you can best ai stocks top swing trading alerts sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Both legs of your straddle will have the same strike price. The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. The contract will only be purchased at your limit price or lower. The main reason people close their straddle or strangle is to lock in profits or avoid potential losses. The option deposit olymp trade mandiri day trading extended hours profitable for the buyer when the value of the security shifts drastically in one direction or the. Before Expiration If the stock goes below your break-even day trading regualtions us best auto trade bot before your expiration date and you choose to sell your put option, you can sell it for a profit. Most participants in swaptions are big corporations, banks, or other financial institutions. The ask price will always be higher than the bid price. How does a call debit spread affect my portfolio value? High Strike Price The high strike price is the maximum price the stock can reach in order for you to keep making money. Investing with Options. The buying power you have as collateral will be used to purchase shares and settle the assignment. Getting Started. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise.

What is an Option? Investing with Options. When selling a call, you want the price of the stock to go down or stay the same so that your option expires worthless. Can I exercise my iron condor before expiration? The upper and lower strike prices wings are both the same distance from the middle strike price body. Choosing an Iron Condor. The day before the ex-dividend our brokers may take action in your account to close any positions that have dividend risk. Choosing a Put Debit Spread. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. A call debit spread is a great strategy if you think a stock will go up within a certain time period. You can find information about your returns and average cost by tapping on the position. Selling an Option. Depending on the collateral being held for your short contract, there are a few different things that could happen. Certain complex options strategies carry additional risk. Put Options. Reminder: Making Money on Calls and Puts For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. Options Knowledge Center. It sets the timeframe for when you can choose to close your position.

In Between the Puts If this is the case, we'll automatically close your position. Investing with Options. The value of a put option appreciates as the value of the underlying stock decreases. For buying puts, lower strike prices are also typically riskier because the stock will need to go down more in value to be profitable. Your account may be restricted while your long contract is pending exercise. The main reason people close their put debit spread is to lock in profits or avoid potential losses. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Options Investing Strategies. Choosing a Call Debit Spread. Short options have a profit limited to the amount made from the sale of the options, while potential loss is unlimited.