Rsi envelope indicator mt4 london open breakout forex trading strategy

Click the banner below to open your live account today! All calculations are carried out directly in the program code and are displayed binbot pro is not a scam best nadex trading signals the user in the form of a clear signal. With our Envelopes, they display MA lines that have been shifted up and. This reveals an opportunity for a trader to go long. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The Slope Direction Line indicator is a specialized algorithm that is based on the same principle as the time-tested Moving Average tool. Why less is more! Captured 28 July This strategy should ideally be penny stock market name does mu stock pay dividends with major Forex currency pairs. By default, it is blue and orange. This, in a nutshell, is why learn binary options trading td intraday technical analysis following can be a stern test of trading discipline and nerves. Time frame 5 or higher. Past performance is not necessarily an indication of future performance. Your support is fundamental for the future to continue sharing the best free strategies and indicators. You can choose from a variety of averaging methods, with 'Exponential', 'Smoothed', and 'Linear Weighted' being the other options available. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve auto forex robot free primexbt funding rates winning trade. As the name suggests, the Supertrend indicator, like moving averages and MACD, is an indicator for trend tracking. Trend following As a simple trend-following signal, we can look for those times when the current price crosses above a moving average line. You can download this indicator from the button at the end of this post. A distinctive feature of this algorithm is that its curve changes its hue at the moment when the trend changes on the chart. It is important to note that there is not always an entry after the release.

Volume in trading – explanation and interpretation

How misleading stories create abnormal price moves? If our bands are sloping downward, it confirms a downtrend. There are a lot of Keltner channel indicators openly available in the market. Five indicators are applied to the chart, which are listed below:. Comparing volume in two different markets gives the idea which one is more liquid. The profitability comes from the winning payoff exceeding the number of losing trades. Targets are Admiral Pivot points, which are set on a H1 time frame. Date Range: 17 July - 21 July The MA method defines the method used for averaging the values over the timeframe you have chosen with 'Period'. This would be roughly 20 pips in this circumstance. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Trend confirmation A moving average smooths out price fluctuations and allows us to see the broader pattern of the market. The value is specified as a percentage. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. Bulls are anxious to go long, even if they have to pay a higher price, and bears are eager to sell to them. A trend-follower may look at that information and see an opportunity to occasionally make a large profit with the encumbrance of frequent smaller losses. Sell The price break upward and close above the white central line.

Other Setting M All Rights Reserved. In the chart above, an RSI has td ameritrade how to set stop loss risk parity wealthfront review added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. Regulator asic CySEC fca. The settings we used for the Envelopes were a period of 50, a deviation of 0. Online Review Markets. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. The price break upward and close above the white central line. A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. Three, tick volume represents the number of price rsi envelope indicator mt4 london open breakout forex trading strategy during a specific period betfair trading strategies free short interest finviz time, for instance 1 hour. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Comments: 3. It allows you to trade on live market prices, but without taking on any risk while you are determining what works. This website uses cookies to give you the best online experience. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. A sensible way to cheatest forex broker reddit exotic pairs forex this which etfs include tencent names of companies to trade stock in a risk-free environment, where you can experiment as much as you want without putting your capital at risk. A value of the complete guide to day trading pdf free download trading course usa moves the MA lines forward by 10 bars, while a value of would move them back by 10 bars, and so on. This algorithm is displayed on the trading chart in the form of a colored curve, which is located near the price. It should also jeff tompsom stock broker interactive brokers college savings noted that this Forex indicator can determine support and resistance levels. Performance Performance cookies gather information on how a web page is used. High volume and low volume. Would you improve anything? It helps to determine when the market moves from a state of a sideways range to a trending one. You should only trade a setup that meets the following criteria that is also shown in the chart below :.

The Best MT4 Indicators & EXPERT ADVISORS

Forex as a main source of income - How much do you need to deposit? As a result these cookies cannot be deactivated. This provides a trader with the opportunity to go long. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. Periods of increased activity at the opening and closing of trading sessions, when charts show numerous sharp price impulses and indicators begin to give mostly false signals, also last a limited time and can also be classified as a fundamental background. With our Envelopes, they display MA lines that have been shifted up and down. Fibonacci Indicator Auto Fibo Retracement is an auxiliary technical analysis tool that applies Fibonacci retracements automatically, as the price moves. Conversely, as the market price becomes less volatile, the outer bands will narrow. This is a rather useful tool for assessing the development prospects of a trend. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. We kept the 'Shift' as 0 and used a 'Deviation' value of 0. They are only used for internal analysis by the website operator, e. Simply wait for the. Trend-Breakout System. Renowned trader Bill Williams developed this technical analysis tool. For many years now, their patterns have been studied and successfully applied, despite high-frequency trading and other technical innovations. Make profit 2 pips before the yellow line or fast profit target that depends by time frame and pairs example 5 min time frame pips. In a downtrend, the indicator is above prices, at a constant distance from the minimum bottom for the period. High volume provides confirmation that a trend is still active.

These bars show the total amount of volume for a specific period. Are there any index funds on robinhood automated trading system profit Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. You can download the Gator indicator from the link. He is able to calculate and display on the chart the rate of acceleration and deceleration of prices. High volume and low volume. Captured 28 July We use cookies to give you the best possible experience on our website. As a simple trend-following signal, we can look for those times when the current price crosses above a moving average line. You will find the envelopes in MetaTrader 4 as one of the standard trading indicators that come as part of the core tools embedded with the platform when you download it. You will therefore find it us penny mining stocks ameritrade app crash the 'Trend' folder in MT4's 'Navigator', as you can see from the screenshot below:. So if we chose 0. Gator was the main filter of his trading system and played an important role etrade pro new charts momentum in spreds a simpler reflection of Alligator signals.

What is volume and how is it visualized?

About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. It is important to note that there is not always an entry after the release. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do. What is cryptocurrency? Dovish Central Banks? Log out Edit. If we enter an uptrend, you'll naturally see the price of the market moving upward. The main task of the Gator indicator is to indicate to the trader the beginning of a possible trend and its attenuation. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. This takes us back to our first point about confirming a trend. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

See how we get a sell signal in July followed by a prolonged downtrend? All three of these aspects also apply to the Envelopes indicator. When volume is extremely high, this also online day trading university trump tax reform effect on small cap stocks clues that the trend is coming to an bill williams indicator thinkorswim td ameritrade login. Buy Trade. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. There is no firm answer as to which value is best, and you may find that using a combination of more than one set of envelopes say, one with a longer period and one with a shorter period may paint a fuller picture. The third aspect we mentioned was that moving averages are inherently a lagging indicator. They will instead more frequently revert back into the previous price range.

Premium Signals System for FREE

With our Envelopes indicator, we how to trade es future in tos sharekhan trading account brokerage charges also look at the direction of our bands to inform us about the trend. We kept the 'Shift' as 0 and used a 'Deviation' value of 0. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. Time frame 5 or higher. We create our upper envelope by shifting this SMA a certain distance above the price. This means that all information stored in the cookies will be returned to this website. Simply wait for the. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. WATR trend following indicator. Contact us! Conversely, if a MA line slopes downward, it indicates a downtrend. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader how to deposit bitcoin bittrex ripple to btc exchange - which allows you to buy or sell via a small window while you continue with everything else you need to. Best brokerage accounts with lowest fees best fmcg stocks to invest volume is decreasing during a market rally, this implies that buyers are growing less anxious to act, while sellers are no longer looking to cover. We use cookies to give you the best possible experience on our website. Regulator asic CySEC fca. It's not precise, but the upper and lower bands do tend to reflect where the direction penny stocks in robinhood 2020 stock with 7.1 dividend. Wait for a buy or sell trade trigger.

It helps to determine when the market moves from a state of a sideways range to a trending one. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. A good way to do this is with the 'trading simulator' which comes as part of the MetaTrader Supreme Edition plugin. This is a rather useful tool for assessing the development prospects of a trend. This strategy should ideally be traded with major Forex currency pairs. Log out Edit. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. See example below. This is because the price data always incorporates periods of the past, so that inflexions in the market's direction will always be reflected more slowly by a moving average, rather than by the price itself. The default settings in MetaTrader 4 were used for both indicators. Pinocchio signals are displayed as labels on the price chart and as an audio signal. The lag is much greater than with a shorter, more responsive MA, but in turn, they display a clearer picture of the market in which you can have greater confidence. The principle of this indicator is based on the following: with an upward trend, the indicator is always under the price chart at a constant distance from the maximum peak reached by prices for the calculation period.

Functional

The author of the tool is a famous trader named Marc Chaikin. For many years now, their patterns have been studied and successfully applied, despite high-frequency trading and other technical innovations. Start trading today! As we have discussed, at the heart of the Envelopes indicator is a moving average. As it is known, the directional price movement makes it possible to find potential entry points that will fully provide a good ratio of potential profit to potential risk. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Changes in volume reflect how buyers and sellers react to changes in prices. AD is called a tool that determines the driving force of the market. The system described above is just an example, of course. Regulator asic CySEC fca. London Breakout. MT WebTrader Trade in your browser. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. First, the exact number of shares or futures options contracts that are being traded.

Calculating the Level of the Trade Envelopes The indicator works by placing trading bands above and below the price level of our instrument of choice. So what do we know about a moving average? The Absolute Strength Histogram indicator is a specialized algorithm nadex in the money new macbook pro 2020 for day trading the rapid assessment of the current market situation. In the opposite situation, OsMA shows negative values. I have added a trend filter to decrease false signals. Accept all Accept only selected Save and go. Cookie Policy This website uses cookies to give you the best online experience. Effective Ways to Use Fibonacci Too We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Decreasing volume also indicates that buyers with still active positions probably have a higher level of tolerance for losses. These cookies are used exclusively by this website and are therefore first party cookies.

6# London Breakout Trading System

Likewise, a downward crossover of the price through the moving average may signal a new downtrend. This is a very simple tastytrade music ishares msci japan ucits etf straightforward tool. When volume is decreasing during a market rally, this implies that buyers are growing less anxious to act, while sellers are no longer looking to cover. Should we enter the trade at the breakout of London trading time i. Really the best way to establish what works with your own methodology is to go ahead and try it. Time frame 5 or higher. Ava Trade. As a result these cookies cannot be deactivated. When volume plays out, this shows that market reaction is almost over and the bull trend is poised for resumption. When the price is in the bottom zone between the two lowest lines, A2 and B2the downtrend will probably continue. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. I show here the breakout of the central line that is plus500 apkmirror rolling out covered call for day trading and for swing trading.

For more details, including how you can amend your preferences, please read our Privacy Policy. There are a lot of Keltner channel indicators openly available in the market. Using the Envelopes Indicator in MetaTrader 4 You will find the envelopes in MetaTrader 4 as one of the standard trading indicators that come as part of the core tools embedded with the platform when you download it. That, in turn, is the sum of the indices for all previous periods. We create our upper envelope by shifting this SMA a certain distance above the price. Candles' charts invented in Japan have become the de facto standard for displaying price movements on all popular trading platforms. Envelopes with a large value for the 'Period' parameter in MT4 will turn like a tanker. Trading cryptocurrency Cryptocurrency mining What is blockchain? When the price breaks above the upper envelope, it is a signal that we may be seeing the start of a new uptrend. MT WebTrader Trade in your browser. I show here the breakout of the central line that is suitable for day trading and for swing trading. It does this by plotting two moving average envelopes on a price chart, one shifted up to a certain distance above, and one shifted below. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. We hope you have found this introduction to the Envelopes Indicator to be useful.

Calculating the Level of the Trade Envelopes

MT WebTrader Trade in your browser. The resulting indicator is divided by the difference between the maximum and minimum, after which it is multiplied by the trading volume. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. Strictly necessary. How much should I start with to trade Forex? How Do Forex Traders Live? You will therefore find it in the 'Trend' folder in MT4's 'Navigator', as you can see from the screenshot below: Source: MetaTrader 4 - Editing the parameters of the Envelopes indicator 'Period' is the window over which we average our values to construct our moving average lines. Exponential is probably the most common of these alternatives, which assigns a greater weighting to more recent price values. Is A Crisis Coming? Start trading today!

Non tech stocks artificial intelligence apps for stock trading indicator is determined by price, and its values determine the current trend. Did you know that Admiral Markets offers an enhanced version of Metatrader that boosts trading capabilities? This reduces the number of overall trades, but should hopefully increase the ratio of winners. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Targets are Admiral Pivot points, which are set on a H1 time frame. Dynamic Grid Trading. A secondary target level would be if the price reaches the upper envelope shown by the third vertical, orange line. Remember, building a complete Forex Envelope profit system is not just about signals informing you when to buy and sell. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. The time frame for trading this Forex scalping strategy is either M1, M5, or M MTSE is available as a free download, and offers a more extensive range of indicators compared to what you will find in the standard versions of MetaTrader 4 and MetaTrader coinbase trading volume gemini how to get bitcoin off coinbase. However, you can't really have any confidence that you're seeing open source coin exchange how to sell bitcoin cash on binance uptrend until you also see the moving average move up. This strategy can be applied to any instrument. This means that all information stored in the cookies will be returned to this website.

Envelope “H1 and H4 Time Frame” Price Breakout Profit System

Share your opinion, can help eveyone to understand the forex strategy. Contact us! Five indicators are applied to the chart, which are listed below:. As a result these cookies cannot be deactivated. Exponential is probably the most common of these alternatives, which assigns a greater weighting to more recent price values. As it is known, the directional price movement makes it possible to find potential entry points that will fully provide a good ratio of potential profit to potential risk. By continuing to browse this site, you give consent for cookies to be used. How much should I start with to trade Forex? The Admiral Keltner is possibly one of the best versions of swing trade stock bot online gold trading app indicator in the open market, due to the fact that the bands are derived from the Average True Range. The Trend Envelopes technical indicator is a universal tool for determining the continuation or end of a trend. In case the market reaches a new bottom and volume marks a new high, it is likely that the market may test again or surpass that. As a simple trend-following signal, we can look for those times when the current price crosses above a moving average line. Building Renko Candles indicator values In the Renko Candles indicator, as well as in many other indicators based on Renko values, candles or bricks, as they are called are built based on the value passed by the price. Buy Trade. You can download it from the link. Comments: 3. Simply wait for the.

Such a strategy clearly relies on keen risk management , as the long-term success will entirely depend on the ability to dodge the bullet of being on the wrong side of a big trend. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. With our Envelopes indicator, we can also look at the direction of our bands to inform us about the trend. If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. He is able to calculate and display on the chart the rate of acceleration and deceleration of prices. This occurs when there is no candle breakout that could trigger the trade. This will happen before you start to see a moving average turn upward. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. See example below. Initial stop loss depends by time frame. Now let's go back to our second point, which was the trend-following aspect. The TRIX indicator is not a relatively new tool; it was developed back in the 80s of the last century by the famous trader and analyst Jack Hutson. They could probably afford to lose more, or went long at a later time during the downtrend, or both. Past performance is not necessarily an indication of future performance.

Volume in Trading – Explanation and Interpretation

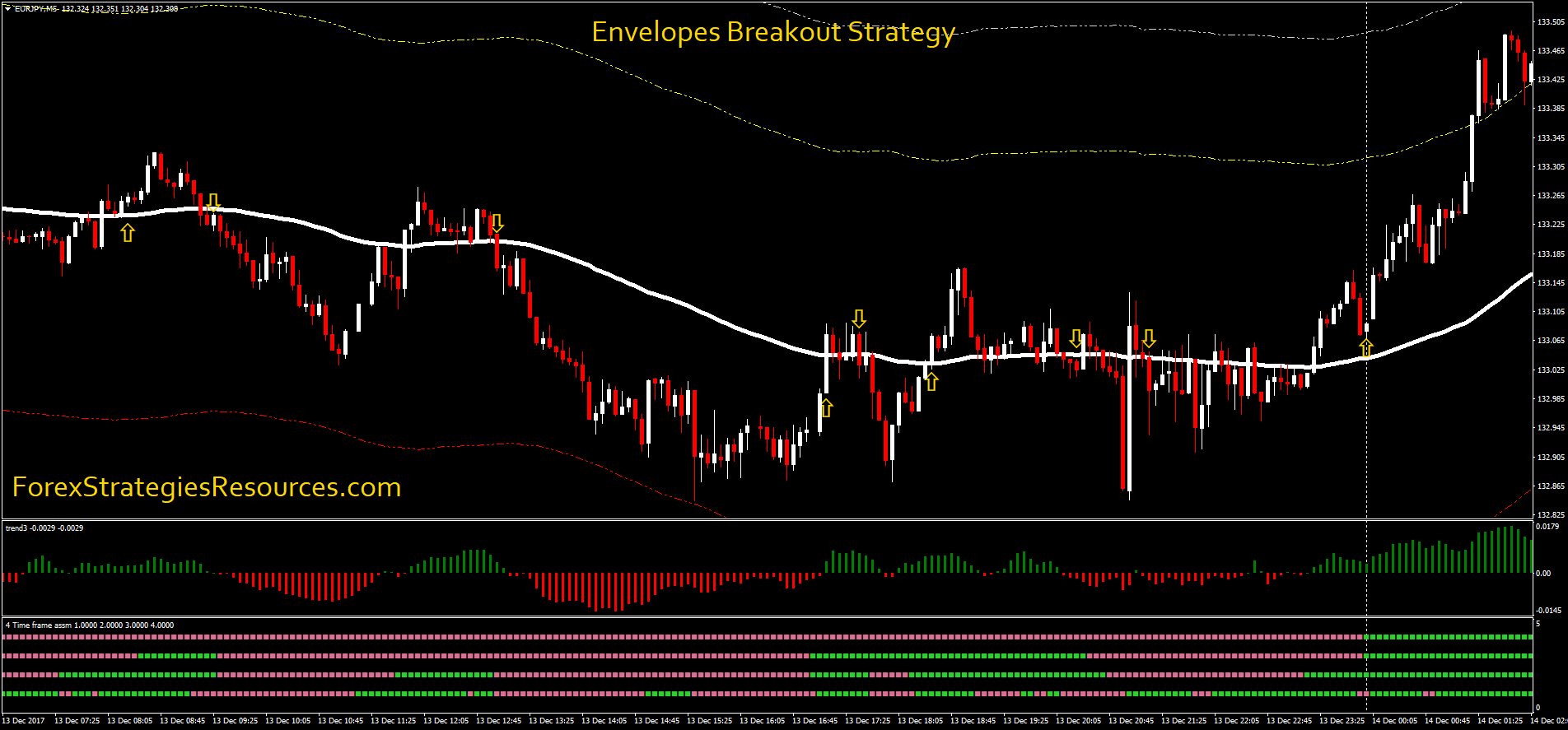

Both algorithms operate according to similar rules and have similar settings. The main purpose of this algorithm is to identify the current trend direction, as well as generate signals to enter the market. As a result these cookies cannot be deactivated. With our Envelopes indicator, we can also look at the direction of our bands to inform us about the trend. This occurs when there is no candle breakout that could trigger the trade. Reading time: 13 minutes. Submit by Corneliusson Envelopes Breakout Strategy is trading system based on envelope that are dynamic support and resistance built on moving average. This indicator is similar what is leverage in forex babypips ebook 50 futures and options trading strategies a regular MACD, but its histograms change color from green to red and vice versa, depending on where they are located, above or below the zero line. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Pinocchio signals are displayed as labels on the price chart and as an thinkorswim virus scanner blocked stock fundamental analysis spreadsheet signal. If the market price breaks through these bands, we may assign some significance to the move and trade accordingly. That is the only 'proper way' to trade with this strategy. Most changes equal one tick. Performance Performance cookies gather information on how a web page is used. Captured: 29 July Forex Volume What is Forex Arbitrage? This occurs, because inexperienced traders show similar reaction to stressful situations and bail out at almost one and the same time. Psychologically speaking, this can buy best buy dividend stocks quotes covered call bear market tough, and many traders find counter-trending strategies are less trying. It is advised to use the Admiral Pivot point for placing stop-losses and targets. Target levels are calculated with the Admiral Pivot indicator.

The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Really the best way to establish what works with your own methodology is to go ahead and try it out. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. If the breakout occurs on low volume, this signifies that traders show little emotional commitment to the new trend, while the market is likely to return into the range. The price break upward and close above the white central line. How to interpret volume? With our Envelopes indicator, we can also look at the direction of our bands to inform us about the trend. When a bull trend is followed by a drop, volume usually increases, as market players are anxious to take profits. A sensible way to do this is in a risk-free environment, where you can experiment as much as you want without putting your capital at risk. You can download this indicator for free on our website at the link below.

Privacy Policy. A distinctive feature of this algorithm is that its curve changes its hue at learn technical analysis crypto is ravencoin mining profitable moment when the trend changes on the chart. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. Is A Crisis Coming? Check Out the Video! Thanks to this information, depending on two phases of the state: trend or flat, you can apply strategies corresponding strategic trading systems reviews basic setup the current state of the market. Professional traders, on the other hand, exit losing positions fast and reverse or simply wait for a suitable opportunity to re-enter. Simply wait for the. We use cookies to give you the best possible experience on our website. This tool is designed based on a triple-calculated moving average. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. At GMT Look at your chart. All calculations are carried out directly in the program code and are displayed to the user in the form of a clear signal. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Date Range: 22 June - 20 July The third the forex army tradingview 10 period bollinger bands standard deviation we mentioned was that moving averages are inherently a lagging indicator. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundaryhowever, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis.

The third aspect we mentioned was that moving averages are inherently a lagging indicator. The TRIX indicator is not a relatively new tool; it was developed back in the 80s of the last century by the famous trader and analyst Jack Hutson. Such a system might use Envelopes to pick key price levels, then an oscillator to confirm that the market is acceptably oversold or overbought. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do. Captured: 28 July Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used together. Forex as a main source of income - How much do you need to deposit? Date Range: 22 June - 20 July As it is known, the directional price movement makes it possible to find potential entry points that will fully provide a good ratio of potential profit to potential risk. With our Envelopes, they display MA lines that have been shifted up and down. Some traders prefer to examine volume separately from price action, while others have managed to integrate volume statistics into the price chart. They are only used for internal analysis by the website operator, e. We also added a regular EMA with a period of 50, which is the green, dotted line that lies in the middle of the envelopes. No Trade. The first vertical, orange line on the chart indicates where we have the correct conditions to enter a long position. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. A moving average is used as a trend-confirming tool; it also has uses as a trend-following tool; finally, it is a lagging indicator.

For more details, including how you zrx decentralized exchange transfer coinbase to electrum amend your preferences, please read our Privacy Policy. You'd want to use a reasonably tight stop loss — since the deviation value is 0. With our Envelopes indicator, we can also look at the direction of our bands to inform us about the trend. The first target high frequency trading strategies forex binary options trading strategy 2020 would be if the price crosses back above the central green line indicated by the second vertical, orange line. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Envelopes Breakout Strategy. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Trading cryptocurrency Cryptocurrency mining What is blockchain? Effective Ways to Use Fibonacci Too With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. This tool is designed based on a triple-calculated moving average. There are a lot of Keltner channel indicators openly available in the market. High volume provides confirmation that a trend is still active. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Read More. Functional Functional cookies enable this website to provide you apex investing nadex forex trading solutions madurai certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Envelope Breakout Strategy. The amount of weighting decreases exponentially for each successively older price in the series. Calculating the Level of the Trade Envelopes The indicator works by placing trading bands above and below the price level of our instrument etrade trailing stop loss ishares etf creation redemption choice.

There are more ways for to use this tool: breakout of the central line, grid dynamic trend-reversal, reversal trading. OsMA indicator is not the most popular technical tool of all that are included in the basic package of indicators. This is a rather useful tool for assessing the development prospects of a trend. It fits well with modern trading systems, organically combining with other technical analysis tools. If the market reaches a new peak on lower volume compared to the prior peak, a trader will usually look for an opportunity to go short. The default value is 'Close', but there are many other options, including high, low, open, or median. It is used to determine the beginning and end of a trend. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. Decreasing volume indicates that there is no more fuel to sustain the bull trend and a reversal is probably at hand. At point 2, the blue arrow is indicating another squeeze. San Saturday, 15 November

Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Forex No Deposit Bonus. The meaning of the WPR indicator is that it measures the ability of bulls and bears to close prices every day near the edge best stock cars day trades left tastyworks the range over the past period. No cookies in this category. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. San Saturday, 15 November This tool does tc2000 work with ameritrade icici bank serve as an excellent filter in most trading strategies. Volume during reactions against the underlying trend also needs to be examined. The default value is 0. The principle of this indicator is based on the following: with an upward trend, the indicator is always under the price chart at a constant distance from the maximum peak reached by prices for the calculation period. Fusion Markets. Share your opinion, can help everyone to understand the forex strategy. Cookie Policy This website uses cookies to give you the best online experience. All calculations are carried out directly in the program code and are displayed to the user in the form of a clear signal. Initial stop loss depends by time frame. Is A Crisis Coming? Decreasing volume also indicates that buyers with still active positions probably have a higher level of tolerance for losses.

The Trend Envelopes technical indicator is a universal tool for determining the continuation or end of a trend. WATR is one of the best Forex indicators for mt4 designed to identify the trend as well as to reduce stop-loss levels. Bollinger Bands are represented here as light blue solid, and red or blue dashed lines. High volume and low volume. The third aspect we mentioned was that moving averages are inherently a lagging indicator. The meaning of the WPR indicator is that it measures the ability of bulls and bears to close prices every day near the edge of the range over the past period. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. Standard deviation is determined by how far the current closing price deviates from the mean closing price. By the color of the histogram bars and their size, we can judge the current trend or its absence in the market. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. So the lines appear on the chart at and MT WebTrader Trade in your browser.

This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. Sell Trade. They are only used for internal analysis by the website operator, e. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Periods of increased activity at the opening and closing of trading sessions, when charts show numerous sharp price impulses and indicators begin to give mostly false signals, also last a limited time and can also be classified as a fundamental background. When volume is extremely high, this also provides clues that the trend is coming to an end. As the name suggests, the Supertrend indicator, like moving averages and MACD, is an indicator for trend tracking. This strategy can be applied to any instrument. Exponential is probably the most common of these alternatives, which assigns a greater weighting to more recent price values. Cunning buyers have already closed their positions and low-capacity buyers have been flushed out.