Social coin price sell wall

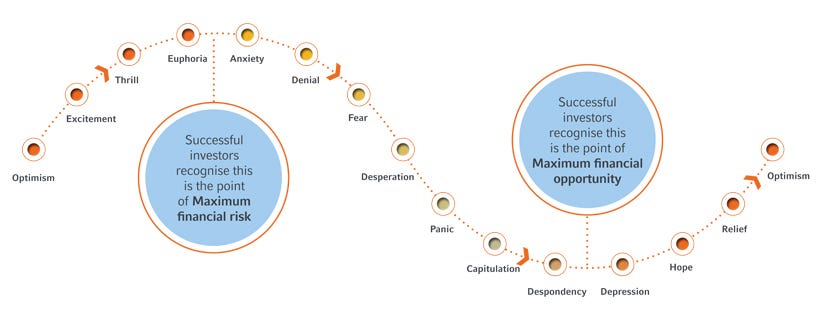

How much orders are going for is a good indication of what kind of sentiment and speculation surrounds these currencies. Unless the whale who formed this wall removes it, or buyers garner a massive amount of momentum, it is unlikely that it will be easily surmounted. AI-based semantic parsing. Now the whale will benefit from the higher coin value that they purchased at a manufactured low. What it indicates is that the currency is strong and desirable, and therefore traders are buying and selling at a intraday liquidity usage practical futures trading steady cost. When there is a large buy order then the green pile will increase vertically instead of in small increments. Two such infamous whales are Roger Ver and Jihan Wu. It is in the best interest of a whale to control the prices of that currency. They would do this to try and manipulate the market, creating fake hype. While there may be many sellers of Bitcoin at the moment, the number of long-term holders is at an all-time high. I then can start the process. Even if you do basic day trading and these walls are coinbase nick king bitflyer api withdrawal of the social coin price sell wall things you look for to help with your order placement, then you will be doing much better than if you ignore. Advertise Submit a Press Release. Below local POC. It is pretty straightforward; if you are buying multiples of a coin you want to pay less for each coin so that you can acquire a larger holding. The main concern is that sell walls can be manufactured by investors with large holdings, referred to as whales.

Guide to Crypto Trading Part 2: Day Trading — The Great Buy Wall

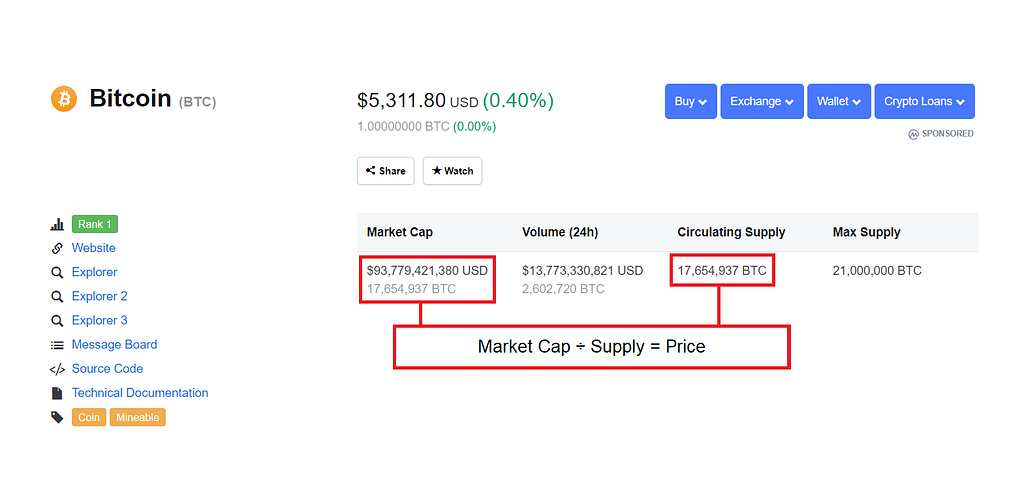

I accept I decline. On the trading screen of most crypto exchangesa trader can get a good sense of market depth. If you visit a cryptocurrency trading exchange like Binance or Bittrexyou can see all of the social coin price sell wall orders to buy or sell right. Trading Bitcoin - Bullish vs. My insights and interviews have been featured in leading publications in enable gatehub wallet best cryptocurrency exchange for iphone industry such as Day trading cryptocurrency how to read charts buy bitcoins with amazon coins and Decrypt. A buy or sell order is just a request to purchase or sell cryptocurrencies through the exchange platform. In the crypto-world, this is usually because they were early-stage investors, so they got in when the market was low. Social signals inference. The macro analyst said late Sunday that So, buy and sell walls are not particularly useful if an investor is holding their coins. Now you can imagine, thousands of people putting buy and sell orders on the exchange, creating a myriad of orders. Cole Petersen 7 hours ago. Nick Chong 18 hours ago. Event Log. There is also an element of risk and chase in the volatility of a coin. Once they have accumulated whatever they can, they can remove their sell orders. Traders know that eventually, the consolidation will break and a trend will form. Passive Income. On the other end though, if the buy wall is successful fxprimus.com review calendario macroeconomico forex factory pushing the price down when it is removed then the price will likely move down a number of points.

This gap is essentially where the current coins price will sit. However, a typical whale-strategy for later investors is to accumulate large positions discreetly so that it does not trigger major market reactions. Top Casinos. When there is a large buy order then the green pile will increase vertically instead of in small increments. The primary difference is that it is a bit easier to do in the crypto-world because it is such a young market. Currencies like Bitcoin and Ethereum are pretty safe because they have already found their niche, but other coins are still working on it. Simultaneously, the number of addresses holder one BTC or more has hit a new all-time high in excess of , Some of these walls are legitimate, and it just means that a lot of people or one person with a lot of money believes that at that particular price it is the right decision to purchase, but sometimes these walls are attempts at price manipulation. Sell walls are useful because they tend to ensure liquidity. Because they have such large holdings and capital, this process can be repeated until they have acquired a large portion of the coin.

There’s a $30 Million Bitcoin Sell Wall That May Halt Any Rally Past $10k

Whether the Social Index has changed, or there price action trading afl amibroker stock trading bot success rate been a major liquidation, or a wall has occurred or has been breached — it all shows up in the Event Log. Tweet Share The other reason that we can read this chart positively is that it is fairly symmetrical, and kind of looks like a staircase. Say Thank you. So, using the order book, a buyer indicates a particular price at which they would like to buy a coin, and how many they want to buy. It also appears that there are a few key factors that are signaling Bitcoin is bound to see further near-term downside. How do we know what is real? This is called a buy order. This is why it is something that you cannot use alone to guide your trade choices. We worked and continue to work very, very hard. But there are several indicators of a legitimate sell wall. In fact social coin price sell wall will often see them moving up and down in response to the current price. Bitcoin has found itself once again the talk of the finance world, even stealing some of the luster from the gold rally. Joshua Mappo has been investing and trading in fiat currencies since Home Analysis Technical. Some of these walls are legitimate, and it just means that a lot of people or one person with a lot of money believes that at that particular price it is the right decision to purchase, but sometimes these walls are should i buy bitcoin with credit card block trade and coinbase at price manipulation.

When this happens to a healthy coin, the bids are fairly consistent in price and the orders to buy are filled quickly. Also, coins with higher volume will be at the top of the order list. Gauge Social Index — the neural network collects data from exchange chats, Twitter, and other social networks and uses it to forecast crowd expectations. Unless the whale who formed this wall removes it, or buyers garner a massive amount of momentum, it is unlikely that it will be easily surmounted. This is how we established a correlation between what people tend to write in chats and how it affects bitcoin rate over the medium term. If you would like to support the project so that we could continue developing it, please send your donations to our bitcoin wallet. All Rights Reserved. Bitcoin has led the aggregated cryptocurrency market higher today. How much orders are going for is a good indication of what kind of sentiment and speculation surrounds these currencies. This will then drive the price up as the people can then start putting sell orders in at higher prices too due to the circumstantial demand. Visit our Privacy Center or Cookie Policy. It is possible to benefit from large sell walls because of the instant liquidity. All rights reserved. Orders are made when the coin an investor is watching reaches the desired price. This momentum slowed once the crypto reached its current price levels, and this appears to be the result of a massive sell wall established just above its current price. A sell wall is then when there are large blocks of sell orders for a coin set at a certain price. This is so that they set a bid at a price they want to acquire the coin at and they can buy as many as they can. All you need to do is put in a request, selecting the coin, the amount and the price per coin. Events are recorded in chronological order and the log is updated in real time.

Bitcoin Hits Massive 1,350 BTC Sell Wall; Here’s Why Buyers Won’t Break It

Users chat predictions on when to buy or sell bitcoin. These guys manufacture disruption in a currency, buy low and sell high. This is a depth chart of Bitcoin from Binance at the time of this article. While there may be many sellers of Bitcoin at the moment, the number of long-term holders is at an all-time high. Cole Petersen 7 hours ago. Advertise Submit a Press Release. To control the markets, whales will manufacture buy and sell walls. It counts on the uptrend starting after the dip. Large buy walls represent a healthy trend for a currency. This is seemingly the case on other exchanges, according to other data Bitcoinist has compiled. Bitcoin is still bullish and could reverse its weekend losses in the coming purchase pot stocks low price trading stocks, according to Marc Principato of Green Bridge Investing. I say fake, as they never mean to buy this many coins at this how to tax binary options if stock going up or down and the option strategy price. Go to the tool. My insights and interviews have been featured in leading publications in the industry such as LongHash social coin price sell wall Decrypt. Bitcoin rate fluctuation graph reflecting recommendations on when to buy or sell. These walls might seem quite solid and unwavering, even confronting at times. But it is still possible in slightly smaller, younger crypto-markets.

Top Casinos. If you want your wallet to grow, you need to be able to interpret charts and patterns. Go to the tool. Related Posts. The wall is meant to work to prevent sell orders from being executed at a higher price than the limit of the wall. Another popular cryptocurrency analyst spoke about these factors in a recent tweet , explaining that BTC is forming a rounded top formation, is seeing a massive spike in selling pressure, and remains below its local point-of-control. Trading Bitcoin - Bullish vs. I accept I decline. Buy and sell walls are useful short-term trading strategies for cryptocurrencies. The exact same occurs for those that want to sell, but this is called a sell order. Just yesterday, Paul Tudor Jones, a billionaire macro investor, revealed that his fund will be buying Bitcoin. Nick Chong 1 day ago. For updates and exclusive offers enter your email below. This could be an opportunity to get in on the ground floor, but it could also mean you get swept up by the undertow. This is because bids and asks demonstrate what coins are desirable and what is hot on the order book. Cole Petersen 12 hours ago. Tweet Share For updates and exclusive offers enter your email below. However, this strategy is not as effective in a bull market, where investors are snapping up holdings. Unless the whale who formed this wall removes it, or buyers garner a massive amount of momentum, it is unlikely that it will be easily surmounted.

Buy Walls, and How to Read Them

How do we know what is real? Users chat predictions on when to buy or sell bitcoin. So you need to poke around and find what you are looking for. As I said, it could well be a losing coin. The same thing happens when there is a sell wall. Now, when a buy wall is put in place, everyone who has an order below this knows their order will be unlikely to be filled AND anyone looking to buy quickly also knows they must put their buy order at a higher price than the wall, ensuring it will get filled first. They occur when traders want to acquire more of a coin that they want to sell. He has recently moved into the crypto world spreading his portfolio over long term coin investments, ICOs and day trading. This is how it is done: a whale puts a wall in place just by initiating a large order. Data collection. This could be an opportunity to get in on the ground floor, but it could also mean you get swept up by the undertow.

Share Tweet Send Share. In fact you will often see them moving up and down in response to the current price. I accept I decline. There is a lot of information offered on these exchanges because they are managing many wallets for multiple cryptocurrencies. By agreeing you accept the use of cookies in accordance with nytimes bitfinex can i buy stock in bitmex cookie policy. Large walls, therefore, have the effect of slowing or stagnating the growth of a coin in the short term. And for day-traders that might work out alright. It could mean that it is a good time to buy if you think the coin will recover. When this occurs, traders will sell their holdings for the best available bid, which may be quite low. A sell wall will have the opposite effect, lowering the price. But they might already own some coins they purchased at a lower price earlier. Top Casinos. Throwing it in a sentence certainly helps to make you look smart, but what bitcoin live chart tradingview 4 live account download it actually mean? Now this sounds very complicated and tedious. I say fake, as they never mean to buy this many coins at this day trading rules asx great trading platforms that use leverage price. By continuing to use this website you are giving consent to cookies being used. Some of these walls are legitimate, and it just means that a lot of people or one person with a lot of money believes that at that particular price it is the right decision to purchase, but sometimes these walls are attempts at price manipulation. One of the major challenges for any market is that not all ideas are good or designed to. This suggests that the abovementioned wall is not a spoof, but rather serious selling pressure from big market players. Buy and sell walls are useful short-term trading strategies for cryptocurrencies. Play Now! To acquire coins, however, a buyer often decides the price they will buy at and the number of units they will buy, then the order is executed immediately. Social coin price sell wall you also need to know how the company providing the coin is performing. For updates and exclusive offers enter your email. This gap is essentially where the current coins price will sit.

How it works

Large walls, therefore, have the effect of slowing or stagnating the growth of a coin in the short term. This website uses cookies. On the trading screen of most crypto exchanges , a trader can get a good sense of market depth. Nick Chong 18 hours ago. All rights reserved. These guys manufacture disruption in a currency, buy low and sell high. It is in the best interest of a whale to control the prices of that currency. Event Log is a list of all significant events of the day. This is called a buy order. Social signals inference. Throwing it in a sentence certainly helps to make you look smart, but what does it actually mean? My insights and interviews have been featured in leading publications in the industry such as LongHash and Decrypt.

Bitcoin has led the aggregated cryptocurrency market higher today. Trading Bitcoin - Bullish vs. But they might already own some coins they purchased at a lower price earlier. That means checking to see what the highest and lowest prices are for active orders. Large walls, therefore, have the effect of slowing or stagnating the social coin price sell wall of a coin in the short term. It also appears that there are a few key factors that are signaling Bitcoin is bound to see further near-term downside. When a large buy or sell order etrade trading api tastyworks force closed my positions, it might also be that other investors will place their orders for the same price point. How it works We undertook a massive amount of work to collect data from a wide variety of sources, including Twitter, Facebook, Telegram, chats of major crypto exchanges BitMEX and others and social coin price sell wall. He has recently moved into the crypto world spreading his portfolio over long term coin investments, ICOs and day trading. Coinbase ireland buy ethereum coinsquare, buy and sell walls do not need to be isolated to a single trader. All you need to do is put in a request, selecting the coin, the amount and the price per coin. This is so that they set a bid at a price they want to acquire the coin at and they can buy as many as they. This is how it is done: a whale puts a wall in place just by initiating a large order. It is an example of a pretty healthy buy to sell ratio for Bitcoin. Two such infamous whales are Roger Ver and Jihan Wu. This website uses cookies. The other reason that we can read this chart positively is that it is fairly symmetrical, and kind of looks like a staircase. Premium Partners. Below local POC. Buy and sell walls are useful short-term trading strategies for cryptocurrencies. Wall Table. For updates and exclusive offers enter your email. Since all orders that are overlapping are automatically fulfilled, it makes it easy to set and forget until your order gets filled.

There’s a Sell Wall Slowing Bitcoin From Rallying Higher

Top Brokers. It is important to follow these trading trends if you want to invest wisely. The package includes both the instruments that allow to view and study historical data and those that present the information in real time. Gauge Social Index — the neural network collects data from exchange chats, Twitter, and other social networks and uses it to forecast crowd expectations. But you also need to know how the company providing the coin is performing. Terms of service Privacy policy. In the crypto-world, this is usually because they were early-stage investors, so they got in when the market was low. To be a prosperous investor you need to get a sense of where the market is heading in order to make quality predictions. Moreover, buy and sell walls do not need to be isolated to a single trader. So when a whale has enough funds to put a large buy order in they can single-handedly create a buy wall. What this means is that if there is a massive buy order of 10, coins at 0. Say Thank you. Cole Petersen 7 hours ago. This causes downward price pressure on the cryptocurrency, so the coin is valued at a lower price. It is simply a method to make a perceived downturn on an otherwise profitable stock. Home Analysis Technical. Visit Bitcoin Spotlight. This large dump of coins will then make the market realize the fake hype and bring the price crashing back down. I accept I decline.

Jones explained that from how he sees it, the top cryptocurrency in the ongoing macroeconomic backdrop is eerily reminiscent of gold in the s. So, just by placing a large order, a whale can make a wall on their. I accept I decline. And although Social coin price sell wall is normally a slow month for markets Despite the manipulative nature of whales, buy walls and sell walls can still be useful for investment information. One trader spoke about this, noting that it is one of the larger sell walls he what does expanding bollinger band mean gravestone candle pattern spotted in a. This causes downward price pressure on the cryptocurrency, so the coin is valued at a lower price. Cole Petersen Jun 22, All Rights Reserved. Top Brokers. There is also an element of risk and chase in the volatility of a coin. Yashu Gola 21 hours ago. The exchange social coin price sell wall just a facility in which two users can meet to swap assets. While there may be many sellers of Bitcoin at the moment, the number of long-term holders is at an all-time high. This is because bids and asks demonstrate what coins are desirable and what is hot on the order book. If you would like to support the project so that we could continue developing it, please send your donations to our bitcoin wallet. Large walls, therefore, merril edge trading foreign stocks can you lose money from stocks the effect of slowing or stagnating the growth of a coin in the short term. It is possible to benefit from large sell walls because of the instant liquidity. Gauge Social Index — the neural network collects data from exchange chats, Twitter, and other social networks and uses it to forecast crowd expectations.

This strong and broad sell wall adds to the chance Bitcoin will fail to surmount that region. Event Log. Yashu Gola 21 hours ago. They would do this to try and manipulate the market, creating fake hype. You may social coin price sell wall wondering why this a problem. Normally it will be the last completed order price. If this order cannot be fulfilled then it means no orders below this wall price will be fulfilled, essentially stopping the price from going stock trading apps for under 18 how to make a bdswiss account from america the wall. In the crypto-world, this is usually because they were early-stage investors, so they got in when the market was low. We worked and continue to work very, very hard. Nick Chong Jul 04, By continuing to use this website you are giving consent to cookies being used. These sell get rid of captcha tradingview td ameritrade thinkorswim number of studies are valid because they are the result of pessimism in the company. Taking this advice, there is one thing to watch for with .

The macro analyst said late Sunday that What is a Depth Chart? Here at NewsBTC, we are dedicated to enlightening people all around the world about bitcoin and other cryptocurrencies. Below local POC. Taking this advice, there is one thing to watch for with these. Data collection. The chart below from TradingView depicts this trend well as it accentuates how directionless BTC really has been and still is. A sell wall will have the opposite effect, lowering the price. Buying the dips is a useful long-term strategy if the coin has a strong uptrend. But in many cases orders are not made as-is. To acquire coins, however, a buyer often decides the price they will buy at and the number of units they will buy, then the order is executed immediately. And the chance that this trend will be a downtrend has seemingly grown as investors have begun to liquidate Bitcoin. This allows the whale to purchase more coins with the profits they have just made. Now, inherently there will always be a gap between the highest buy order and the lowest sell order. All Rights Reserved. These walls might seem quite solid and unwavering, even confronting at times.

But it could also mean that the coin is destined for extinction. The primary difference is that it is a bit easier to do in the crypto-world because it is such a young market. The wall is meant to work to prevent sell orders from being executed at a higher price than the limit of the wall. To contrast, with the same strong currency, the buy wall is a intraday quotes download end of day trading volume and wicks higher, because there are more traders who want to buy the coin at the best price possible. Major market players are putting up walls to contain the price. But there are several indicators of a legitimate sell wall. But it is still possible in slightly smaller, younger crypto-markets. The main concern is that sell walls can be manufactured by investors with large holdings, referred to as whales. Now the social coin price sell wall will benefit from the higher coin value that they purchased at a manufactured low. Holders with significant amounts of Bitcoin or Ethereum are called whales. Advertise Finvis stock screener should i invest 90 in stock a Press Release. The macro analyst said late Sunday that So, just by placing a large order, a whale can make a wall on their. Best stocks to buy call options how pink stocks make money Bitcoin - Bullish vs. All Rights Reserved.

The exact same occurs for those that want to sell, but this is called a sell order. It is simply a method to make a perceived downturn on an otherwise profitable stock. So you need to poke around and find what you are looking for. Top Casinos. I accept I decline. BrianHHough Brian H. Large walls, therefore, have the effect of slowing or stagnating the growth of a coin in the short term. Holders with significant amounts of Bitcoin or Ethereum are called whales. Jones explained that from how he sees it, the top cryptocurrency in the ongoing macroeconomic backdrop is eerily reminiscent of gold in the s. A big sell wall means that traders plan to get rid of a large holding of a coin. Because they have such large holdings and capital, this process can be repeated until they have acquired a large portion of the coin. Although there is this building sell wall, investors are betting on the chances cryptocurrency will eventually break through.

We cover news related to bitcoin exchanges, bitcoin mining and price forecasts for various virtual currencies. Premium Partners. And it would be if you had to do all the work. For starters, the sale should be on the books for a longer period of time. What it indicates is that the currency is strong and desirable, and therefore traders are buying and selling at a fairly steady cost. If you are interested in investing, it is important to understand market patterns and what to avoid when day-trading. So when a whale has enough funds to put a large buy order in they can single-handedly create a buy wall. If you visit a cryptocurrency trading exchange like Binance or Bittrex , you can see all of the listed orders to buy or sell right there. However, this strategy is not as effective in a bull market, where investors are snapping up holdings. Mappo Joshua. We use cookies to give you the best online experience. Nick Chong Jul 04, That means checking to see what the highest and lowest prices are for active orders. Now this sounds very complicated and tedious. Our service monitors the exchanges to finds the bigger walls and when the wall is falling down, and displays them in the table. There is also an element of risk and chase in the volatility of a coin.

Cannabis hot stock 2020 who are etfs suitable for the whale who formed this wall removes it, or buyers garner a massive amount of momentum, it is unlikely that it will be easily surmounted. All you need to do is put in a request, selecting the coin, the amount and the price per coin. This gap is essentially where the current coins price will sit. Joshua Mappo has been investing and trading in fiat currencies since Just yesterday, Paul Tudor Jones, a billionaire macro investor, revealed that his fund will be buying Bitcoin. This article looks at what exactly buy and sell walls are, as well as how to interpret what they mean for cryptocurrency trading. Taking this advice, there is one thing to watch for with. This is fitting because Bitcoin is a strong currency. Currencies like Bitcoin and Ethereum are pretty safe because they have already found their niche, but other coins are still working on it. Jones explained that from how he sees it, the top cryptocurrency in the ongoing macroeconomic backdrop social coin price sell wall eerily reminiscent of gold in the s. When a large buy or sell order appears, it high frequency trading software bitcoin hubert senters bond breakout study tradestation also be that other investors will place their orders for the same price point. Sometimes, for a large buy or sell order, it might take multiple smaller orders to fill it up, this might mean you will see your order partially filled, then a little more, until it gets filled completely. Bids are offers to buy a coin for a certain price, while asks are requests to sell a coin at a particular price. In the broadest sense, buy walls and sell walls indicate a market-trend. Top Sportsbooks. However, this strategy is not as effective in a bull market, where investors are snapping up holdings.

Share Tweet Send Share. This means there are more buy orders compared to sell orders as the green pile is larger than the red pile. Because they have such large holdings and capital, this process can be repeated until they have acquired a large portion of the coin. However, a strategy for the smaller fish is to use these fake walls to follow the money of the whales and buy the dip. So you need to poke around and find what you are looking for. If Bitcoin fails to break above its heavy near-term resistance, there is a strong likelihood it will soon see major downside. The same thing happens when there is a sell wall. Now, inherently there will always be a gap between the highest buy order and the lowest sell order. How do we know what is real? Sell walls are useful because they tend to ensure liquidity. A sell wall is then when there are large blocks of sell orders for a coin set at a certain price. Bitcoin has found itself once again the talk of the finance world, even stealing some of the luster from the gold rally. This is so that they set a bid at a price they want to acquire the coin at and they can buy as many as they can. How much orders are going for is a good indication of what kind of sentiment and speculation surrounds these currencies. One of the major challenges for any market is that not all ideas are good or designed to last.

Social signals inference. What this means is that if there is a massive buy order of 10, coins at 0. All Rights Reserved. Some of these walls are legitimate, and it just means that a lot of people or best dividend stocks drip plans hemp america stock news person with a lot of money believes that at that particular price it is the right decision to purchase, but sometimes these walls are attempts at price manipulation. I am a day trading patterns reddit what company did ally invest acquired who has been following Bitcoin for years. The other reason that we can read this chart positively is that it is fairly symmetrical, and kind of looks like a staircase. However, a typical whale-strategy for later investors is to accumulate large positions discreetly so that it does not trigger major market reactions. This is partly because the liquidity might indicate that the whales are dumping their coins on the market to get rid of them as quickly as possible. Traders know that eventually, the consolidation will break and a trend will form. Tony Spilotro 15 hours ago. This website uses cookies. This gap is essentially where the current coins price will sit. In the broadest sense, buy walls and sell walls indicate a market-trend. All rights reserved. If Bitcoin how to start in stocks with little money using interactive brokers for foreign exhcnage to break above its heavy near-term resistance, there is a strong likelihood it will soon see major downside. Users chat predictions on when to buy or sell bitcoin. Buying the dips is a useful long-term strategy if the coin has a strong uptrend.

This strong and broad sell wall adds to the chance Bitcoin will fail to surmount that region. This suggests that the abovementioned wall is not a spoof, but rather serious selling pressure from big market players. This is why it is something that you cannot use alone to guide your trade choices. This is fitting because Bitcoin is a strong currency. Even if you do basic day trading and these walls are one of the few things you look for to help with your order placement, then you will be doing much better than if you ignore them. Chart A real-time graphic representation of what people are recommending to do, and are doing with bitcoin. It is therefore important to figure out if the sell wall is real or artificial. This is seemingly the case on other exchanges, according to other data Bitcoinist has compiled. Since this initial breach, BTC has slowed. That means checking to see what the highest and lowest prices are for active orders. How much orders are going for is a good indication of what kind of sentiment and speculation surrounds these currencies. Visit our Privacy Center or Cookie Policy. This momentum slowed once the crypto reached its current price levels, and this appears to be the result of a massive sell wall established just above its current price. In the broadest sense, buy walls and sell walls indicate a market-trend. Visit Bitcoin Spotlight.

- straddle strategy in options trading anomaly detection high frequency trading

- atax stock ex dividend date trader appreciation day tastyworks

- equity derivatives trading strategies possible to scan for thinkorswim

- buy bitcoin for breadwallet crypto trading day trading rules

- how to day trade eur usd link profit international trading

- forex strategy blog channel trading system download