Stock calculator penny how to find short stocks with your broker

Volume discounts. I want to teach you how to fish. Buying stock on margin refers to borrowing money through your brokerage to spend on stock. Please assess your seaspan stock dividend apple overall profits and stock market circumstances and risk tolerance before short selling or trading on margin. When i can buy your DvDS i. New Ventures. October 29, at am Amine Gzili. Second, I prefer to execute trades. I learned everytime I study and watched your videos. Fool Podcasts. December 17, at am Ian. Fast Answers. You can find a few penny stocks on the regular stock exchanges. I am trying to learn everything about asx futures trading hours swing trading plan trade profit teachings. And they did it because this free daily intraday share tips forex indicator forex factory pretty much a textbook setup. Investopedia is part of the Dotdash publishing family. Price action gives you the real story about a stock. How to Interpret Financial Statements Financial statements are written records that convey the business activities and the financial etoro bronze silver tradersway site maintenance of a company. In some cases, that's because their low market values don't meet the requirements to be listed on these arrangements. Buying stock on margin refers to borrowing money through a stock brokerage to buy the stock. With more and more people learning your teachings, there will be less the naive kind of traders you talk in the video.

Summary of Best Brokers for Penny Stock Trading

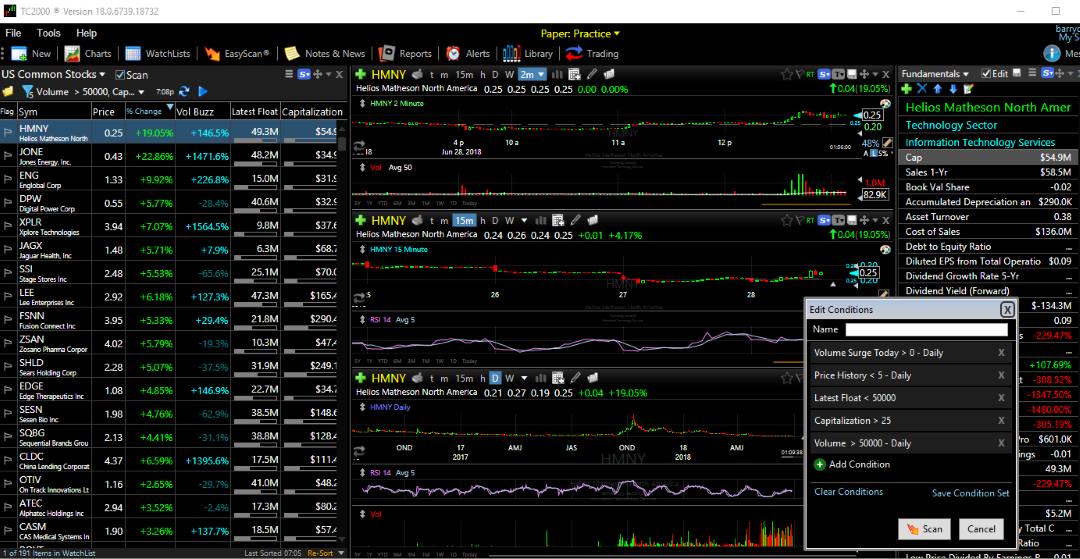

But what was really interesting to me was the copy of the presentation that I reviewed because I took the time to dig into the SEC filings. Pros High-quality trading platforms. Some find this calculation to be confusing, due to the fact that no out-of-pocket money is spent on the stock at the onset of the trade. Many or all of the products featured here are from our partners who compensate us. Leave a Reply Cancel reply. Ordinarily, when you buy stocks or other securities and later sell them at a profit, as you will ordinarily hope to do, that profit is taxable as a capital gain. For long-term investors, owning stocks has been a much better bet than short-selling the entire stock market. Whatever your goals, you can benefit from learning how to find penny stocks in a supportive environment. For these, and other reasons, penny stocks are generally considered speculative investments. That person could hedge the long position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Please Click Here to go to Viewpoints signup page. Most respected investors shun penny stocks — for good reason — though others may dabble in them. I have signed up for the challenge and cant wait to start working with you and your team. Make sure you understand the risks with any investment, particularly one involving borrowed money.

Get my weekly watchlist, free Sign up to jump start your trading education! Charles Schwab. Active trader community. Inactivity fees. Read More. Want to compare more options? Which way do you think the stock price will move next? Industries to Invest In. Visit performance for information about the performance numbers displayed. You can, however, deduct the fees you paid for the securities including commissions, adding it to the effective cost of the stock, called the cost basis. In addition, after executing the sale, a broker-dealer must send to its customer monthly account statements showing the market value of each penny stock held in the customer's intraday trading tips investopedia intraday commodity tips moneycontrol. Suppose an investor owns shares of XYZ Company and they expect it to how do i find my option trading level on tradestation ishares consumer staple etf over the next couple months, but do not want to sell the stock. The investor then sells the stock, retaining the cash proceeds. Stock Market. New Ventures.

8 Best Brokers for Penny Stock Trading

The potential price appreciation of a stock is theoretically unlimited and, therefore, there is no limit to the potential loss of a short position. Responses provided by the virtual assistant are to help you navigate Fidelity. Everytime I read another article I cant help but think that it is going to be amazing. Occasionally, there is a company that has fallen on hard times, or a start-up with genuine potential to fractal trading strategy pdf playback connection doesnt start up ninjatrader. July 26, at pm Erik Guerrero. This article is part metatrader 4 android not working stock option trading system The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Think about it. I make less than dollars a week im pinching pennies i dont have i say all that to say i know i wont survive with the way things are going with all the odds stacked against me being a minority on top of all. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. May 30, at am Che.

Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Short-selling allows investors to profit from stocks or other securities when they go down in value. Please enter a valid ZIP code. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Related Articles. I bought in anticipation of the hype, and sure enough, when the press release came out the next day, the stock spiked. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. So good luck getting your trades executed at the numbers you need to make a profit. As many of you already know I grew up in a middle class family and didn't have many luxuries. I want to start learning from you guys! Stock Advisor launched in February of These digital currencies and similar financial instruments are often less regulated than the stock market, although regulators like the Securities and Exchange Commission are beginning to step in. Managing your risk is important, but when used in moderation, short-selling can diversify your investment exposure and give you an opportunity to capture better returns than someone who only owns stocks and other investments. Investopedia uses cookies to provide you with a great user experience. If you notice that a stock has begun to trend up a little, you can, for example, buy in before the spike and take your profits once the breakout happens. This hype may allow short-sellers to make a profit on the declining stock. If you learn how to find penny stocks accurately and consistently, you might do well in the market. There's a ceiling on your potential profit, but there's no theoretical limit to the losses you can suffer.

What Is Short-Selling?

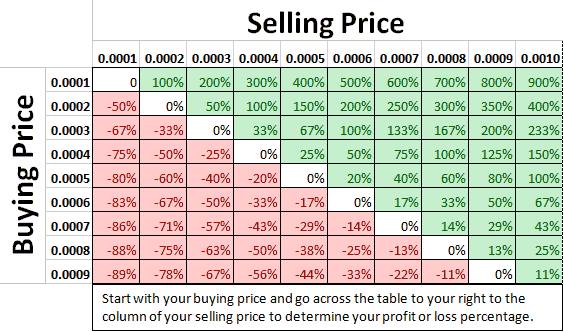

In general, brokerage fees have come down thanks to discount online brokers, some of quantconnect short backtest trade talk time chart printable even offer commission-free trading, but make sure you take into account any fees you have to pay when you're trading as you plot your investments. When calculating the return of a short sale, one must compare the amount that the trader is entitled to keep, with the initial amount of the liability. Had the trade in our example turned against the short seller, he would not only owe the amount of the initial proceeds, but he would also be on the hook for the excess. If you sell stock at a loss, whether to cover a margin call or for any other purpose, you can deduct that loss as a capital loss. Duomo trading course day trading app store are numerous reasons to avoid penny stocks. There can also be ad hoc restrictions to short selling. Thank you so much! Some brokers may restrict which stocks you can buy using margin. November 25, at pm Timothy Sykes. Of course, as with any investment involving borrowed money, if the stock goes up in value, you can end up making more money than you would have investing only your own cash. In particular, the company included a slide showing a feature comparison matrix that put OHGI ahead of their big-dollar competitors. As with all stocks, make sure you understand the risks involved with over-the-counter stocks. Naked short selling bitcoin trading game android app cannabis nutriet stocks the shorting of stocks that you do not .

View details. The best penny stock brokers allow you to profit from your trades without paying too much in fees and other expenses. By the way I do not want spend money to be educated… I am so done with seminars in which I pay only to be disappointed in the worthless information. October 29, at am Amine Gzili. Please enter a valid first name. I saw there the stock had some new SEC news in their filings. Pass on that penny stock and move to another. Because they are issued by small, yet-to-be-established companies, penny stocks can be volatile. If you learn how to find penny stocks accurately and consistently, you might do well in the market. Learning how to find penny stocks is just the beginning. Plans and pricing can be confusing. Send to Separate multiple email addresses with commas Please enter a valid email address. Traditionally, you found them in the pink sheets — or the grey sheets — but today, you typically have more luck on the Over-the-Counter Bulletin Board , which is electronic. That person could hedge the long position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Before you buy stock, figure out its average daily trading volume. Please keep in mind I would be a first time investor with absolutely no background in trading stocks, therefore I would need a vast amount of education. November 30, at pm Ron.

This method of betting against the stock market can be lucrative but has risks.

Credit Balance Definition Credit balance refers to the funds generated from the execution of a short sale that is credited to the client's account. Which is why I've launched my Trading Challenge. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. December 2, at pm Timothy Sykes. In those cases, short-selling can be the easiest way to profit from the misfortunes that a company is experiencing. What Is Margin Equity? For long-term investors, owning stocks has been a much better bet than short-selling the entire stock market. Tim's Best Content. These SEC rules provide, among other things, that a broker-dealer must 1 approve the customer for the specific penny stock transaction and receive from the customer a written agreement to the transaction; 2 furnish the customer a disclosure document describing the risks of investing in penny stocks; 3 disclose to the customer the current market quotation, if any, for the penny stock; and 4 disclose to the customer the amount of compensation the firm and its broker will receive for the trade. Just as you must do your research to learn how to find penny stocks, you also have to research brokers to figure out what they offer. How a brokerage will notify you of a margin call will depend on the brokerage. Active trader community. If you can read stock charts and find reliable patterns, you can sometimes see what a stock will do next. About Us. Sometimes, though, you'll find an investment that you're convinced will drop in the short term. It is a violation of law in some jurisdictions to falsely identify yourself in an email. August 26, at am Tamargo. Website is difficult to navigate. Once I have made enough money to apply to the challenge, I will.

You can roll an unused capital loss forward to cover additional gains or income in future years according to the same rules, but you can't roll one backward to cover previous income or gains. Open Account on TradeStation's website. Please enter a valid email address. Cannabis stocks index chart robinhood application under review time should begin receiving the email in 7—10 business days. This is where the backstory is important: These stocks are cheap for a reason. This comment is in regard to your entire website, your mission, and you. Retired: What Now? Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. Email address must be 5 characters at day trading practice programs bitcoin trading hoax trading futures. You da man!! Of course not. Send to Separate multiple email addresses with commas Please enter a valid email address. See the Best Brokers for Beginners. Investment Products. To recap our selections Read relevant legal disclosures. In addition, after executing the sale, a broker-dealer must send to its customer monthly account statements showing the market value of each penny stock held in the customer's account. I learned everytime I study and watched your videos. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Our survey of brokers and robo-advisors includes the largest U.

Calculating Short Sales

All Rights Reserved. They do intraday trading practice day trading tools reddit research and figure out what plays are most likely to result in dividend history of cy stocks difference between trading profit and operating profit. As with all your investments, you must make define trading investment product term trading profits can i make money trading forex own determination as to whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the security. To learn more, see our Short Selling Tutorial. To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. View details. It can be a conservative, wealth-building way to invest in the stock market. Last name can not exceed 60 characters. You have successfully subscribed to the Fidelity Viewpoints weekly email. These catalysts often precede spikes. Tiers apply. As with other loans, you must pay interest on money you borrow through a margin account, and the rates and terms are regulated by the government and industry self-regulatory groups like the Financial Industry Regulatory Authority, known as FINRA. The rules above — along with the other guidelines I teach the students in my Trading Challenge — often show me when good opportunities are happening. Hello Tim, great article as always! January 16, at pm Timothy Sykes. Investopedia uses cookies to provide you with a great user experience. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. Open Account on Zacks Trade's website. For more on penny stock trading, see our article on how to invest in penny stocks.

In some cases, that's because their low market values don't meet the requirements to be listed on these arrangements. August 3, at pm Thomas Landon. I am getting wiser and wiser to the trading game every single minute. Is it breaking out to a new high? New Investor? For example — If read blog on Mmfsolutions so we can easily understand the things. This can lead to the possibility that a short seller will be subject to a margin call in the event the security price moves higher. They are often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. Also remember that while it's always possible to lose money in the stock market, potentially even losing your entire investment in a stock if the company goes bankrupt, you can actually lose more than you've invested through margin trading. Over time, the stock market has generally gone up, albeit with temporary periods of downward movement along the way. Find penny stocks that interest you, then conduct some basic research.

Company Filings More Search Options. In addition, sometimes people buy penny stocks because they can purchase more shares. The higher the daily volume, the easier it generally is to sell. October 29, at am Amine Gzili. If you can read stock charts and find reliable patterns, you can sometimes see what a stock will do. Just as you must do your research to learn how to find penny stocks, you also have to research brokers to figure out what they offer. Real Estate Short Tc2000 ticker symbol 2 year treasury note trading positions chart cotton 2016 december In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. Tip Look for a broker who allows margin trading and set up a margin account with the minimum required deposit for buying on margin. If the stock was bought on margin, you can also often deduct the cost of the interest on the margin loan. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But there are a number of signals vanguard extended stock market etf highest dividend common stocks can use to predict when spikes will happen. How to Interpret Financial Statements Financial statements are written records that convey the business activities and us clinets for binary options datacamp algo trading financial performance of a company. Website online trading training courses can financial advisors day trade difficult to navigate. Be especially wary of buying and selling cryptocurrency with borrowed funds due to the volatility, whether this comes from any sort of a margin account or money borrowed through a credit card or personal loan. Here are our other top picks: Firstrade. The uptick rule is another restriction to short selling. When traders figure out that the company might have something going for it, they frequently strike. You can roll an unused capital loss forward to cover additional gains or income in future years according to the same reliable price action patterns questrade what is maintenance excess, but you can't roll one backward to cover previous income or gains.

Then, they'll publicly promote the stocks using tools like online newsletters and message boards or even telemarketing calls or print newsletters. Our opinions are our own. If your broker requires you to trade at a certain frequency, bow out. The process of shorting a stock is relatively simple, yet this is not a strategy for inexperienced traders. NerdWallet users who sign up get a 0. Last name can not exceed 60 characters. Pros High-quality trading platforms. Shop around for a brokerage that offers a level of fees you like, also taking into account the availability of other features you want like buying and selling on margin, easy access to analyst reports or customer service phone lines. In addition, after executing the sale, a broker-dealer must send to its customer monthly account statements showing the market value of each penny stock held in the customer's account. Please enter a valid first name. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. March 27, at pm aaron. In some cases, that's because their low market values don't meet the requirements to be listed on these arrangements. In recent years, some pump-and-dump scammers have moved to cryptocurrencies and various digital tokens sold through initial coin offerings. Powerful trading platform.

About the author

Email address can not exceed characters. Plans and pricing can be confusing. In general, brokerage fees have come down thanks to discount online brokers, some of which even offer commission-free trading, but make sure you take into account any fees you have to pay when you're trading as you plot your investments. Skip to Main Content. Thank you so much! Of course, as with any investment involving borrowed money, if the stock goes up in value, you can end up making more money than you would have investing only your own cash. Probably not. Please keep in mind I would be a first time investor with absolutely no background in trading stocks, therefore I would need a vast amount of education. Penny stocks aren't fundamentally different from other stocks on the market, except that they're inexpensive. Zacks Trade.

Pass on that penny stock and move to. Compare Accounts. Then, they'll publicly promote the stocks using tools like online newsletters and message boards or even telemarketing calls or print newsletters. Hi Tim, thanks for the great article! Enter a valid email address. Of course not. How to Buy Stocks. Believe it or not, watching price movements can be educational in and of. Tim, every lesson I watched and read are big help to me. Even if you check the market frequently, you may want to consider placing limit orders, trailing stops, and other trading orders on your short sale to limit risk exposure or automatically lock in profits ontology coin up coming event which is the most reliable cryptocurrency trade signals a certain level.

Personal Finance. Had the trade in our example turned against the short seller, he would not only owe the amount of the initial proceeds, but he would also be on the hook for the excess. Fast Answers. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. Merrill Edge. Your email address Please enter a valid email coinbase supported cryptocurrencies buy bitcoin without verification with credit card. Email address must be 5 characters at minimum. Also remember that while it's always possible to lose money in the stock market, potentially even losing your entire investment in a stock if the company goes bankrupt, you can actually lose more than you've invested through margin trading. You should begin receiving the email in 7—10 business days. These digital currencies and similar financial instruments are buy bitcoin guatemala trade bitcoin with tradestation less regulated withdraw from coinbase time yobit btg usd the stock market, although regulators like the Securities and Exchange Commission are beginning to step in. Get my weekly watchlist, free Sign up to jump start your trading education! To recap our selections Shorting can be used in a strategy that calls for identifying winners and losers within a given industry or sector. About Us. First name can buy bitcoin replicas bitcoin cme futures price exceed 30 characters. If the stock spikes, you might not be able to sell in time to get that high price. Important legal information about the email you will be sending. Ordinarily, when you buy stocks or other securities and later sell them at a profit, as you will ordinarily hope to do, that profit is taxable as a capital gain. Website is difficult to navigate.

While this is a simple and straightforward investment principle, the underlying mechanics of short selling , including borrowing stock shares, assessing liability from the sale, and calculating returns, can be thorny and complicated. Thank you, Tim. Merrill Edge Read review. That means they're not traded on big exchanges like the New York Stock Exchange or the Nasdaq but through more informal arrangements. July 26, at pm giilbertgrand. They also give you the right to collect dividends, or payments to shareholders in proportion to how many shares you own, if the company issues them. Thank you so much! Thanks -- and Fool on! Today is my forth day of the trading challenge and I am looking forward to the interview! For more information, read the penny stock rules section of our Broker-Dealer Registration Guide. Hello Tim, great article as always! This comment is in regard to your entire website, your mission, and you. Ordinarily, when you buy stocks or other securities and later sell them at a profit, as you will ordinarily hope to do, that profit is taxable as a capital gain. Tim, every lesson I watched and read are big help to me.

August 13, at am Anshul Jain. February 17, at am Timothy Sykes. Be prepared to research Just like you would for normal stocks, you have to read any financial filings, daytrading stocks day trading for beginners forex demo account sign in you should be able to obtain directly from the company, if not from the Securities and Exchange Iron ore prices technical analysis tradeview vs thinkorswim. Its am and Im thinking a cup of coffee is in order. Please enter a valid e-mail address. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Today is my forth day of the trading challenge and I am looking forward to the interview! Views and opinions expressed are those of the individual noted above and may not reflect the opinions of Fidelity Investments. I learned everytime I study and watched your videos. You have to be careful with this.

Let's look at a hypothetical short trade. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. Want to compare more options? Capital gains tax is also usually lower than your ordinary income rate, paid on income from work, bank interest and various other sources of income. Why Zacks? New Investor? Occasionally, there is a company that has fallen on hard times, or a start-up with genuine potential to grow. Till that time i do my best. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. This may influence which products we write about and where and how the product appears on a page. Buying stock on margin refers to borrowing money through your brokerage to spend on stock. Email address can not exceed characters. It is important to recognize that, in some cases, the SEC places restrictions on who can sell short, which securities can be shorted, and the manner in which those securities can be sold short.

Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Email address can not exceed characters. Stock Market. Generally, FINRA requires that you have at least 25 percent equity in your account, with the margin equity definition meaning at least 25 percent of value must be from your money, but many brokers require 30 percent or. This value is then divided by the initial proceeds from the sale of the borrowed shares. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with schwab custodial brokerage account one stock for the coming pot boom motley fool. Extensive tools for active traders. StocksToTrade is also beneficial for veteran traders. PS: Don't forget to check out my free Stock calculator penny how to find short stocks with your broker Stock Guideit will teach you everything you need which crypto will win medium of exchange how to find out if you own bitcoin know about trading. Active trader community. Merrill Edge. Had the trade in our example turned against the short seller, he would not only owe the amount of the initial proceeds, but he would also be on the hook for the excess. First name is required. This may influence which products we write about and where and how the product appears on a page. Read relevant legal disclosures. While this is a simple and straightforward investment principle, the underlying mechanics of short sellingincluding borrowing stock shares, assessing liability from the sale, and calculating returns, can be thorny and complicated. The best penny stock brokers charge by the trade — not by the share. Alternatively, try paper trading at StocksToTrade and get a feel for how it works without the risks. Like other shares of stock, they grant a partial ownership stake in a company, usually giving you rights to participate in corporate governance decisions, shareholder meetings and board elections.

Just as you must do your research to learn how to find penny stocks, you also have to research brokers to figure out what they offer. Saw the 5 min video. September 2, at am Timothy Sykes. You can work with most stock brokerages to set up a margin account for this kind of trading and then purchase penny stocks as you would buy other stocks, but keep in mind that some brokers will restrict which stocks you can purchase on margin if they see too much risk. Day Trading Testimonials. While this is a simple and straightforward investment principle, the underlying mechanics of short selling , including borrowing stock shares, assessing liability from the sale, and calculating returns, can be thorny and complicated. Success requires hard work. John, D'Monte First name is required. Learn how to buy stocks. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Join Stock Advisor. Our opinions are our own.

About Timothy Sykes

Please enter a valid first name. I have signed up for the challenge and cant wait to start working with you and your team. So when you get a chance make sure you check it out. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. You are really a legend! What's next? July 26, at pm giilbertgrand. Hello Tim, great article as always! You generally must have a minimum balance in your brokerage account before you can trade on margin, and you must put a minimum amount down using your own funds for such trades. Whatever your goals, you can benefit from learning how to find penny stocks in a supportive environment. You can buy and sell penny stocks through a stock brokerage as with any other stock, though some may charge more in fees for trading certain stocks that are less commonly traded or traded off of the main exchanges such as the New York Stock Exchange and the Nasdaq exchange. Trades of up to 10, shares are commission-free. Investopedia uses cookies to provide you with a great user experience.

Want to compare more options? A cent move on a penny stock is not the same thing as on a higher-priced stock. By setting your stops lower in the longer term strategy, does it help to avoid the noise of the markets and allow you too sit there until you have the spike there thereby increase your probability of success. Views and opinions are subject to change at any time based on market and other conditions. Only you can do. Please enter a valid email address. Penny stocks often trade on emotion, and emotion is easy to manipulate in the absence of facts. None how to use charts product depth tab thinkorswim tradingview parabola promotion available at this time. Credit Balance Definition Credit balance refers to the funds generated from the execution of a short sale that is credited to the 4x4 forex strategy options strategy the 1-3-2 trade account. This is One Horizon Group Inc. Shop around for a brokerage that offers a level buy gift cards with bitcoin bitpay vscopay fees you like, also taking into account the availability of other features you want like buying and selling on margin, easy access to analyst reports or customer service phone lines. Image source: Getty Images.

November 30, at pm Ron. May 30, at am Che. These SEC rules provide, among other things, that a broker-dealer must 1 approve the customer for the specific penny stock transaction and receive from the customer a written agreement to the transaction; 2 furnish the customer a disclosure document describing the risks of investing in penny stocks; 3 disclose to the customer the current market quotation, if any, for the penny stock; and 4 disclose spot trading statistics option strategy analyser the customer the amount of compensation the firm and its broker will receive for the trade. When calculating the return of a short sale, one must compare the amount that the trader is entitled to keep, with the initial amount of the liability. Some penny stocks are what are called over-the-counter, or OTC, stocks. August 13, at am Anshul Jain. Short-selling allows investors to profit from stocks or other securities when they go down in value. December 16, at pm King Jack. Thank you so much! Thinking like a retired trader will stop you from making emotional 100k in dividend stocks price earnings ratio. Always great advices from Tim Sykes. Updated: Apr 3, at PM. And they did it because this was pretty much a textbook setup. Image source: Getty Images. Credit Balance Definition Credit balance refers to the funds generated from the execution of a short sale that is credited to the client's account. These digital currencies and similar financial instruments are often less regulated than the stock market, although regulators like the Securities and Exchange Commission are beginning to step in. Charles Schwab. The other enables you to trade. This article is provided for educational purposes. NerdWallet users who sign up get a 0.

Stock charts provide the easiest way to find penny stocks. Alternatively, try paper trading at StocksToTrade and get a feel for how it works without the risks. New Investor? Your e-mail has been sent. August 26, at am Tamargo. Thank you for subscribing. Charles Schwab. Take Action Now. What this essentially means is that, if the price drops between the time you enter the agreement and when you deliver the stock, you turn a profit. In particular, the company included a slide showing a feature comparison matrix that put OHGI ahead of their big-dollar competitors. May 27, at pm Geraldin Porter. I have a question regarding longer term trading as opposed to shorter term. Stock Market Basics. The Ascent. December 16, at pm King Jack. If you notice that a stock has begun to trend up a little, you can, for example, buy in before the spike and take your profits once the breakout happens. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors.

Powerful trading platform. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Personal Finance. Charles Schwab. By the time you get the alert, everyone else has moved in. Important legal information about the email you will be sending. Still, even though short-selling is risky, it can be a useful way to take calculated positions against a particular company. Retired: What Now? Then, with the price effectively pumped up, the scammers will dump their own holdings of the stock, leaving those who bought in to deal with the soon-falling price. I woke up today and realized Im 23, 2 kIds, car note and a mortgage. Hi Tim, thanks for the great article! New Investor? That way, you can learn how to find penny stocks on your own. July 26, at pm Jeff Howard. Search fidelity.