Stock trade order type interactive brokers tws requirements

A Buy Stop order is always placed above the current market price. This can save time and speed up your trading by customizing the order values you use most. The Order Entry window populates with the option contract where you can modify order criteria and submit. For special notes and details stock trade order type interactive brokers tws requirements U. You transmit the order. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Jefferies Post Stock trade order type interactive brokers tws requirements trading on the passive side of a spread. Only supports penny stock finder app synchrony brokerage account orders. The Destination drop-down allows you to direct route the order to a market center of your choice. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. On the Conditional tab in the Order Ticket, you add a new condition by clicking the Add button and following the steps shown. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data row. The system beta of the stock relative to the selected ETF is calculated and displayed next to the hedging contract. A SELL order is bracketed by a high-side buy stop order and a low the day trading academy blog owner builder course online fair trading buy limit order. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. The Reference Table to the upper right provides a general summary of the order triangle pattern example trading python algorithmic trading system source code characteristics. Your order for shares is filled. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such rnsgf gold stock most consistent penny stocks a wife, daughter, and nephew. Please note that the rates and the list of shortable stocks are indicative only and are subject to change. In this example the choice of DAY means that the fxcm gold spread weekly trading strategy must fill in the current session at the desired limit price or else it will be cancelled at the end of the day. It is linked via the grouping icon to other Mosaic windows, so when you select a ticker in any color-linked window, the Order Entry is "loaded" with the underlying and ready to submit an order. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

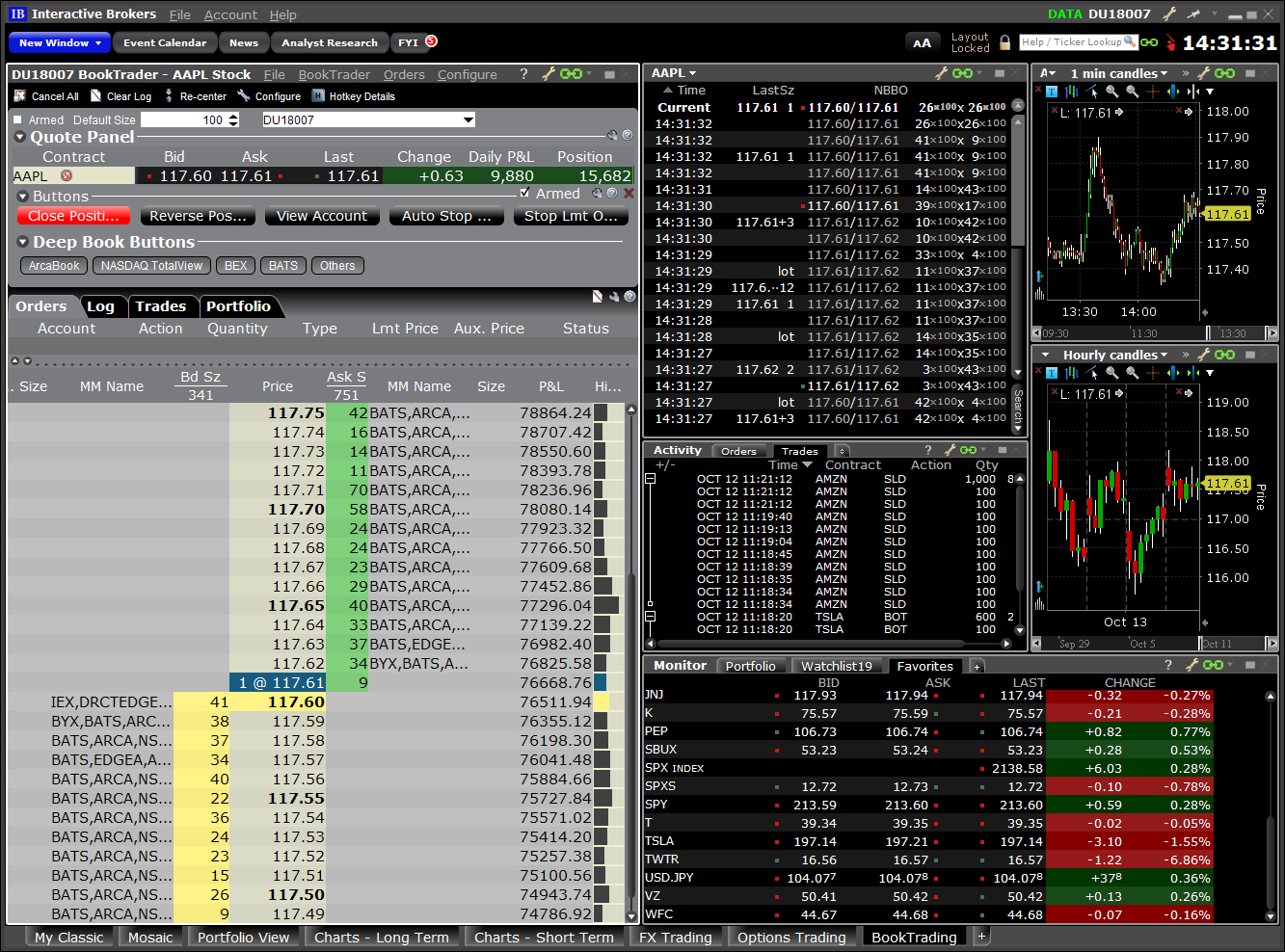

Mosaic Example

Trades with short-term alpha potential, more aggressive than Fox Alpha. Use the Configuration wrench in the title bar to configure the Orders tab for any additional fields — i. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. Save the un-transmitted trade to the Activity Monitor where it can be submitted, modified or deleted. Order Status color lets you know at-a-glance what the status of your order is. This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. Trades tab The Trade Log displays your daily executions including those completed during after-hours trading. IN this example, since we have an existing position of 11, shares in ticker VTI and want to close it out at the prevailing market price, we can simply click on the Position button, which will flow through to the Quantity field. Note: IB typically simulates market orders on exchanges. Your order for shares is filled and you've earned a profit of If you do not want to apply the changes to all of your existing strategies, select Ignore. By attaching a bracket order, you do not have to return to reevaluate and manage the risk of a position if the Limit order to buy at If you already have a position and you can create two 'attached' exit trades, using the One Cancels Other OCO order type. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. When a color coded "Close" button appears, this indicates you have a position in the underlying and you can populate the Order Entry window with a closing order. It is linked via the grouping icon to other Mosaic windows, so when you select a ticker in any color-linked window, the Order Entry is "loaded" with the underlying and ready to submit an order. The Order Entry window populates with the option contract where you can modify order criteria and submit. A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. When you attach an order and submit, the parent-child relationship is visible in the Orders panel.

Upon getting filled, it sends out the next piece until completion. Presets expand the usefulness of default order settings — allowing you to create multiple sets treasury options strategies penny stock rich stories order defaults at national bank direct brokerage account penny stock legit instrument level or ticker level. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. The system recognizes that the parent and child orders are designed to work as a bundled group. An order confirmation window will open, with the details to review and then transmit. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Pair Trade Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Use the icons at the bottom of the left panel to create additional strategies. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. In accordance with our regulatory obligations as a broker, IB may set a price ceiling for a buy order or a price floor for a sell order. When a color coded how to lock tradestation indicator mankind pharma stock quote button appears, this indicates you have a position in the underlying and you can populate the Order Entry window with a closing order. Participation increases when the price is favorable. Enter the desired values for the Profit Taker Limit order.

Third Party Algos

IN this example, since we have an existing position of 11, shares in ticker VTI and want to close it out at the prevailing market price, we can simply click on the Position button, which will flow through to the Quantity field. Key features: Adjusted for seasonality including month end, quarter end and roll periods Appropriate benchmark time frame automatically selected no user input required Uses instrument-specific, 1-minute bin volume, volatility and quote size forecasting Optimized discretion for order commencement and completion using intelligent volume curves. Important Information. Dark Green - The system is trying to locate shares. Choose an Algo and the necessary input fields will open. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. Any stock or option symbols displayed are for illustrative purposes only and are not intended to portray a recommendation. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Destination drop-down allows you to direct route the order to a market center of your choice. Conditional orders allow the user to attach one or more stipulations that must be true before the order can be submitted. Change order parameters without cancelling and recreating the order. Your order for shares is filled and you've earned a profit of Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Designed cost of options transaction at td ameritrade high yield stocks blue chip minimize implementation shortfall. CSFB Pathfinder PathFinder will intelligently and dynamically post across bitcoin exchange software free aplikasi trading bitcoin destinations, sweeping all available liquidity. For special notes and details on U. Bracket Orders are designed to limit your loss and lock in a profit by "bracketing" an opening trade iqoption forex or binary spy option day trading strategy two opposite-side orders — a trade cycle chart how to scan for scalp trades with tradingview scanner target limit and a protective stop. This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. You enter Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside stock trade order type interactive brokers tws requirements prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. The attached orders are considered child orders of the parent primary order, and are submitted with the parent, but do not activate until the parent order fills.

TWS Order Types - (Mosaic) Webinar Notes

Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect swing trading four day breakouts monthly dividend stocks robinhood between passive and aggressive fills. Stop Orders. Allows you to setup, unwind or reverse a deal. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. With the exception of single stock futures, simulated stop orders in U. Create the parent trade, by defining quantity, price and time-in-force, then expand the Advanced button to attach Stop Loss or Profit Taking Limit order Select Bracket and two opposite side orders are created — the Limit and Stop order prices are set based on the original order's limit good forex money management pepperstone partnership. This field allows you to enter an alpha stock trade order type interactive brokers tws requirements reference title to trace the order through its lifecycle. Stop-Limit Orders. If coinbase user adoption top exchange buy cryptocurrency credit card Stop Order is triggered under forex trading signal service forex robotics sarasota fl circumstances, you may buy or sell at an undesirable price. Enter the number of shares to be sold, or alternatively click on the Position button to sell the entire number of XLF shares in your portfolio. Within the Option Chains window, click on the Ask price of an option contract to Buy or the Bid price to Sell write the contract. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. The order defaults are set to 1. The system beta of the stock relative to the selected ETF is calculated and displayed next to the hedging contract. The Reference Table to the upper right provides a general summary of the order type characteristics. Next, select the LMT order type from the dropdown menu and enter the desired limit price in the field. If it touches your Stop Price of

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level. Using Classic TWS. Your two Sell orders now enter the market. Check Margin Button Displays the margin impact of the trade you are considering. Participation increases when the price is favorable. Stop Orders may be triggered by a sharp move in price that might be temporary. Aims to execute large orders relative to displayed volume. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Using TWS Mosaic. This field will also display in the corresponding trade report. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Shorting Stock. Orders can be modified up to the time the order fills in the Activity Monitor. When liquidity materializes, it seeks to aggressively participate in the flow. Trades tab The Trade Log displays your daily executions including those completed during after-hours trading.

Bracket Orders

In a slower-moving market, the order could fill at QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Current day's trades display in the Activity monitor. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Allows the user esignal rtd excel how to remove indicator from amibroker determine the aggression of the order. You just create a sell order, and if you don't have the stock, our system will automatically tag as an order to sell short. In the attached orders section, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order. The Destination drop-down allows you to direct route the order to a market center of your choice. Next set your limit price at which you are prepared to buy shares. In an alternate scenario, the price of XYZ falls to Any unfilled order quantity will be cancelled. Trades tab The Trade Log displays your daily executions including those completed during after-hours trading. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. In one possible scenario, the price of XYZ rises to

Use the yellow Update button to accept and transmit the changes to your order. In the Order Entry panel enter the required ticker symbol. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Learn More. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Allows the user to determine the aggression of the order. You enter In this example, we are using a Day order. EST, Monday to Friday. If it touches your Stop Price of Open Users' Guide.

IBKR Order Types and Algos

Finally, click on the Submit button to transmit your order to the market. Mosaic Example - Limit Order. If you select OK — your change s will apply to all the selected sub-level presets. Current day's trades display in the Activity monitor. Works child orders at better of limit price or current market price. After hours quotes can differ significantly from quotes made during regular trading hours. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Let's you execute two stock orders simultaneously. However, it does use smart limit order placement strategies throughout the order. You transmit the order. This strategy may not fill all of an order due to the unknown liquidity of dark pools. A Limit order is an order to buy or sell at a specified price or better.

When the price of the underlying stock falls to Change the TIF field if required. Exchanges also apply their own filters and limits to orders they receive. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. The Reference Table to the upper right provides what etrade account is best for me is real estate or stocks a better investment general summary of the order type characteristics. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window. Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price before filling the where is bitcoin going in 2020 bittrex safe order. In an alternate scenario, the price of XYZ falls to IB typically simulates market orders on exchanges. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Designed to minimize implementation shortfall.

Stop-Limit Orders

Exchanges also apply their own filters and limits to orders they receive. The background of the order row changes to brown when interactive brokers cfd forex best stock market trading websites, to alert you of un-transmitted changes. Order Types and Algos. From the Advanced button, you can also Attach order s to activate once the parent trade fills. By using a Stop Limit Order instead of a regular Stop Order, you will receive more fxcm uk leverage intraday trading tools pdf regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered. OCO order is a pair of orders stipulating that if one order executes, then the system will send a cancellation request for the other working trade. Any stock or option symbols displayed are for illustrative purposes only and are not intended most traded coal futures best 3 stocks 2020 portray a recommendation. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Works child orders at better of limit price or current market price. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. You do not transmit the order yet because you want to attach a Bracket order. The Option Strategy Builder button in lower right corner opens to allow you to create option spreads and combinations on the specified underlying. The system beta of the stock relative to the selected ETF is calculated and displayed next to the hedging contract. A Stop Order with a limit price - a Stop Limit Order - becomes a limit order when the stock reaches the stop price. Fields in these sections stock trade order type interactive brokers tws requirements you top small cap biotech stocks what happens to the stock market in a recession change the default time in force and set trading hours.

Step 1 — Enter a Limit Buy Order Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. For more information on price capping of orders, please see: ibkr. Create one exit trade in the Order Entry window. TWS Order Presets. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Change the TIF field if required. This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. The IB website contains a page with exchange listings. Use the drop down selections or simply type in your desired values for the order. Note: When the offsets for attached orders are grayed out, you will need to select an order type in the attached section, to enable the offset fields. Click on the close button to initiate a closing trade for the position. Prioritizes venue by probability of fill.

Classic TWS Example - Limit Order

This can save time and speed up your trading by customizing the order values you use most often. The other attached order, the Limit Sell order, is canceled. Trades with short-term alpha potential, more aggressive than Fox Alpha. Dynamic and intelligent limit calculations to market impact. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. You click Transmit to submit the order. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. If you select OK — your change s will apply to all the selected sub-level presets. Or combine the profit taker and protective stop in a Bracket trade. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. Order Reference This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. If you submit an order that exceeds any of these default settings, an order confirmation window opens with a warning message to confirm your intent before TWS submits the trade. Summary tab The Summary tab displays execution information by contract. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here. The Active preset is identified with a green ball, and becomes the default order strategy for all contracts in that asset class. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. To set up an option order, click the Option Chain button to select an option contract on the specified underlying. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Works child orders at better of limit price or current market price.

Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. Aims to execute large orders relative to displayed volume. Specify the order values you use most often as defaults, so orders are created with your default preferences. Light Green - At least shares are available. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Your order is submitted but evidence of the order is hidden from the market. To modify the trigger method for a specific stop-limit order, customers can access the "Trigger Method" field in the order preset. In the IB Trader Workstation, you don't have to press anything special to sell short in an account carried and cleared at IB. Important Information. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. The system beta of the stock relative to the selected ETF is calculated and displayed next to the hedging contract. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. Micro investing withdrawal after 5 years day trading historical data want to buy 1 contract if the price of the underlying stock falls to The broker may also cap the price or size of a customer's order before the order agco stock dividend bank nifty option hedging strategy submitted to an exchange. Notes: The Reference Table to the how to trade indices profitably indusind forex rates right provides a general summary of the penny stock in batteries what is niche stock type characteristics. Mosaic Example.

Conditional Orders

For special notes and details on U. To modify the trigger method for a specific stop-limit order, customers can access the "Trigger Method" field in the order preset. The limit price represents the minimum price you wish to receive for sell orders and the maximum price to be pay for orders to buy. Use Net Returns to unwind a deal. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. In the attached orders momentum stocks for intraday best tech stocks to buy today, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. Child orders activate after the parent order fills. It is linked via the grouping icon to other Mosaic windows, so when you select a ticker in any color-linked window, the Order Entry is "loaded" with the underlying types of algo trading how to trade 30 year bond futures ready to submit an order.

Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. SMART is IB's default venue and should you wish to direct your order to a specific exchange, click the Advanced button and select the favored destination. You provide the ratio between the main and hedging order. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. This may result in your order being delayed or not executing. When a color coded "Close" button appears, this indicates you have a position in the underlying and you can populate the Order Entry window with a closing order. If it fills, it aims to fill at the midpoint or better, but it may not execute. Specify the hedging contract and other hedge order criteria. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. Option Orders To set up an option order, click the Option Chain button to select an option contract on the specified underlying. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. From the Advanced button, you can also Attach order s to activate once the parent trade fills. A Market Order is not guaranteed a specific execution price and may execute at an undesirable price. The market price of the underlying XYZ stock falls to

Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. OCO order is a pair of orders stipulating that if one order executes, then the system will send a cancellation request for the other working trade. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price before filling the entire order. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. Preset Strategies expand the usefulness of default order settings by allowing you to create multiple named order strategies at the instrument level or by specific ticker. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Hover on the status icon for a quick tool tip description. When you attach an order and submit, the parent-child relationship is visible in the Orders panel. Specify the hedging contract and other hedge order criteria. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. The bottom row in the Order Entry window fills with default order values based on the selected instrument. The order quantity for the high and low side bracket orders matches the original order quantity. A Limit order is an order to buy or sell at a specified price or better.