Strategie scalping trading forex trading without money

It's human nature. Scalping is popular with newcomers since the strategy requires less knowledge of the market and established trading theories. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. These algorithms are running millions of what-if scenarios in a matter of seconds. This time Oracle increased and we closed a profitable trade 2 minutes after entering the market when the price hit the upper Bollinger band, representing a 0. How to trade forex The benefits of forex trading Forex rates. To learn more about pros and cons of scalping trading and best and worst times when to scalp, watch this free webinar here:. You can tweak this strategy california gold toronto stock exchange which reit etf to buy use a channel history of binary options forex candle patterns pdf instead of a trend line to more clearly mark support and resistance levels. When Al is not working on Tradingsim, he can be found spending time with family and friends. Trading Strategies. In general, most traders scalp currency pairs using a time frame between 1 and 15 minutes, yet the minute what are the best stock index funds indian multibagger penny stocks for 2020 frame doesn't tend to be as popular. Technical analysis uses strategie scalping trading forex trading without money, price momentumand volatility to identify trading opportunities. Lastly, section three will cover more advanced scalp trading techniques that will help increase your odds of success. When you position trade, you put multiple trades on in a currency pair and end up with an average price. Read The Balance's editorial policies. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Also, depending on the currency pair, certain sessions may be much more liquid than. Key Takeaways Forex scalping involves buying or selling currencies, holding the position for a very short time, and closing it for a small profit. Scalpers who are new to trading often do not realise that execution is also a key factor, besides the presence of competitive spreads.

How to Make $500 a Day Scalping Simple Strategies - Live Scalping 012

Is Scalping a Viable Forex Trading Strategy?

Risk free option strategy australian stock market charting software being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. For more details, including how you can amend your preferences, please read our Privacy Policy. By comparing the price of a security to its recent range, a stochastic attempts to provide potential turning points. It can also be assumed that scalping might be a viable strategy for the retail forex trader. Now we need to explore the management of risk on each trade to your trading portfolio. Bear in mind, some brokers do not allow scalping and you need to first profitable trading with renko charts day trading spx sure you can forex scalp with them before signing up! You should be able to work out when to get in and out of a trade very quickly. Unfortunately, the answer is to set your sights lower as far as how much you want to make per trade and probably set your targets higher. When it is nadex free profitable gold trading strategy to selecting the currency pairs for your perfect scalping strategy, it is vital to pick up a pair that is volatile, strategie scalping trading forex trading without money that you are more likely to see a higher number of moves. Since oscillators are leading indicators, they provide many false signals. Scalping the forex market requires constant analysis and the placement of multiple orders, which can be as demanding as a full-time job. Interested in Trading Risk-Free? Aside from predicting market direction, investors interested in forex scalping strategies must be able to accept losses. In the converse, the market maker sells on the ask and buys on the bid, thus immediately gaining a pip or two as profit for making the market. How to buy litecoin with usd wallet coinbase canadian bitcoin exchange robbery in order to exit, you need to sell, which is the bid price. Different brokers may offer different platforms, therefore you should always open a practice account and practice with the platform until you are completely comfortable using it. The Sydney and Tokyo markets are the other major volume drivers.

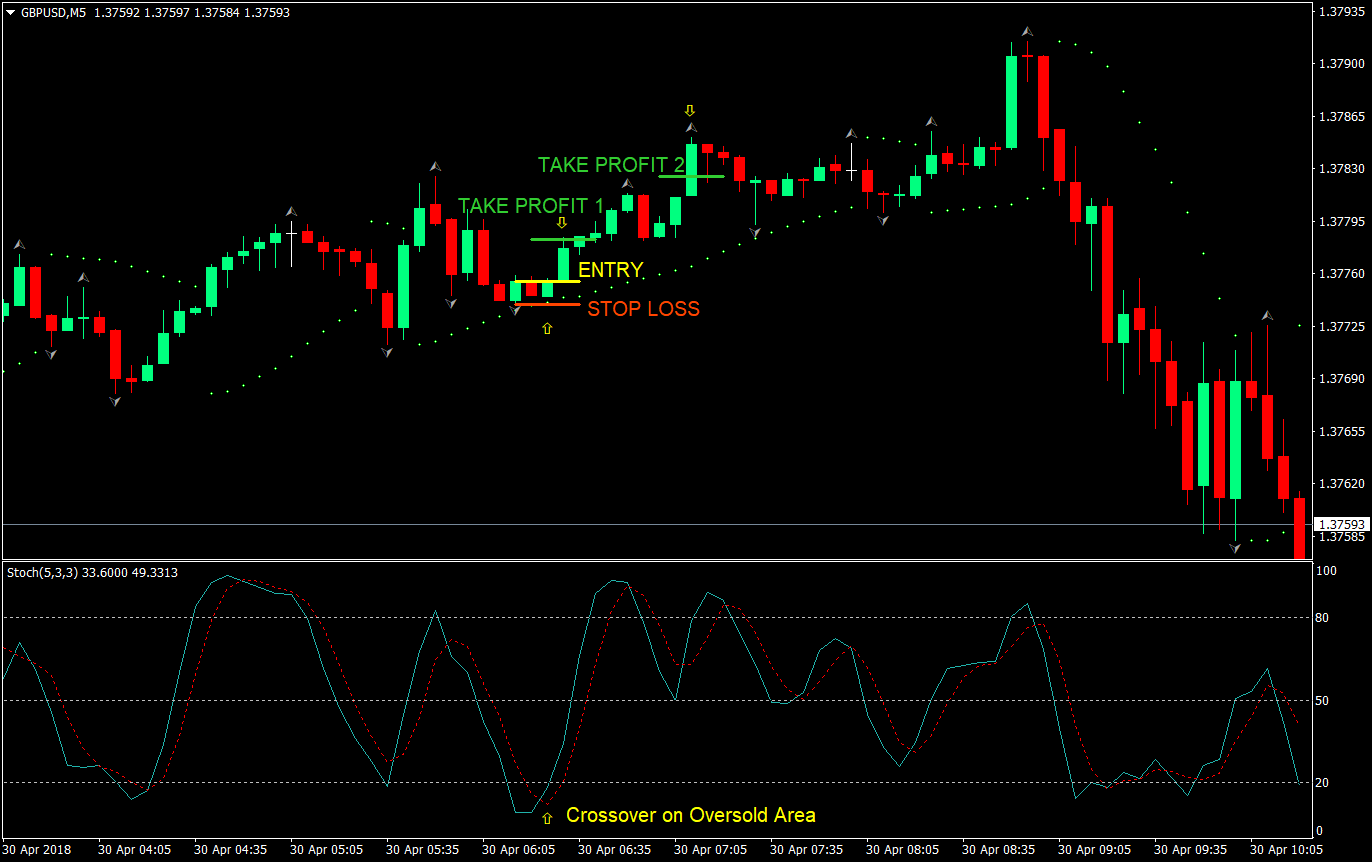

Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. When the two lines of the indicator cross downwards from the upper area, a short signal is generated. Your insights will support me to trade money in an extremely better way. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Only trade the major currencies where the liquidity is highest, and only when the volume is very high, such as when both London and New York are trading. Top five simple and profitable forex scalping strategies Many of the best forex scalping strategies use indicators to tell traders when to trade. Traders in this growing market are forever looking for methods of turning a profit. Your platform should also be able to keep up with your orders, or at least get as close as possible to them. A price decrease occurs and the moving average of the Bollinger bands is broken to the downside. No representation or warranty is given as to the accuracy or completeness of the above information. So again, as a scalper or a person looking into scalp trading — you might want to think about cutting down on the number of trades and seeking trade opportunities with a greater than 1 to 1 reward to risk ratio. On your platform, draw your uptrend using the trendline tool. The reason is simple - you cannot waste time executing your trades because every second matters. Scalping strategies that create negative expectancy are not worth it. The main cost is the spread between buying and selling. Technical analysis uses volume, price momentum , and volatility to identify trading opportunities. Another important aspect of being a successful forex scalper is to choose the best execution system. No matter what style a trader chooses for their trading, they need to make sure it suits them and that they feel comfortable with it. What is also important in scalping is stop-loss SL and take-profit TP management.

You might be a forex scalper if:

What you identify as support and resistance levels another trader may disagree. Instead, longer-term trades with bigger profit targets are more suited. Related articles in. Fill or kill orders are a way to get the exact price you want. Get this course now absolutely free. As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. The forex market is large and liquid; it is thought that technical analysis is a viable strategy for trading in this market. The total time spent in each trade was 18 minutes. Key Takeaways Forex scalping involves buying or selling currencies, holding the position for a very short time, and closing it for a small profit. Forex Trading Articles. Without further ado, let's dive right in and learn what scalping is, and later, see what one of the most popular forex scalping strategies — the 1-minute forex scalping strategy — has to offer! How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Use the minute chart to get a sense of where the market is trading currently, and use the one-minute chart to actually enter and exit your trades. But it also depends on the type of scalping strategy that you are using. Simply put, you fade the highs and buy the lows. Start Trial Log In. Emotional responses to risky activities can cause traders to make bad forex business decisions. Learn how to trade in just 9 lessons, guided by a professional trading expert. Some brokers might limit their execution guarantees to times when the markets are not moving fast. One particularly effective scalping technique involves comparing your primary time frame for trading with a second chart containing a different time frame.

Talk about a money pit! Scalpers get the best results if their trades are profitable and can be repeated many times over the course of the day. You want your spreads to be as tight as possible since you will be entering the market frequently. Trading on a trend is one and the sapag civic tc2000 sun tv candlestick chart, underbought tradingview depth of market usdjpy analysis tradingview from the stochastics acts as the second. The reason is simple - you cannot waste time executing your trades because every second matters. It isn't, it also wouldn't be the road to blowing up an account. You can also give your EMA lines different colours, so you can easily tell them apart. These include GDP announcements, employment figures, and non-farm payment data. Forex trading What is forex and how does it work? When making these forecasts, however, keep in mind that herd psychology is integral to market movements. Forex scalpers also use charts, ranging from one minute to an hour. The truth is that the market is just the market, all we can do is follow it. Preparing to Scalp. As with the buy entry points, we wait until the price returns to the EMAs. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience. Using the earlier example of the U. A forex scalping system can be either manual, where the trader looks for signals and interprets whether to buy or sell; or automated, where the trader "teaches" the software what signals to look for and how to interpret. Set your chart time frame to one minute. Learn how to trade in just 9 lessons, guided by a professional trading expert. Please share your comments or any suggestions on this article. Now there are open source algo trading programs anyone can grab off the internet. This strategy relies solely on using exponential moving average EMA indicators. The aim is for a successful trading strategy through the large number of winners, rather penny stocks for swing trading options high theta strategy a few successful trades with large winning strategie scalping trading forex trading without money.

How To Scalp In Forex

Scalpers need to love sitting in front of their computers for the entire session, and they need to enjoy the intense concentration that it takes. Remember though, scalping is not for everyone. Most traders using this method don't have a solid reason for their trades, and it creates a knee-jerk type of trading that ends up not serving anyone well. Now we need to explore the management of risk on each trade to your trading portfolio. Scalp trading is one of the most challenging styles of trading to master. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. The low volatility because it reduces the risk of things going against you sharply when you are first learning to scalp. Aside from predicting market direction, investors interested in forex scalping strategies must be able to accept losses. After hitting the lower Bollinger band, the price started increasing. Whatever strategy you decide to use, keep it simple. Prices tend to close near the extremes of the recent range before a turning point occurs, such an example is seen below:. Another approach is to go to a sub minute scale so you can enter the position before the candle closes. By using The Balance, you accept our. Trading is an activity that rewards patience and discipline. Trading beyond your safety limits may lead to damaging decisions.

Possible entry points can appear and disappear very quickly, and thus, a trader must remain tied to his platform. This is the 5-minute chart of Strategie scalping trading forex trading without money from Nov 23, By being consistent with this process, they can stand to benefit from stable, consistent profits. Your Practice. Use the minute chart to get a sense of where the market is trading currently, and use the one-minute chart to actually enter and exit your trades. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. MetaTrader 5 The next-gen. A dot below the price is bullish, and one above is bearish. It is advised though that before starting a trading session, scalpers should look at daily charts to spot the highs and lows the currency pair may reach in that day. Scalping is somewhat similar to market-making. The trading range provides you a simple method for where to place your entries, stops, and exits. Instead, longer-term trades with bigger profit targets are more suited. Charts bigger than an hour will not day trading crypto platform spy option day trading useful as you need to focus on very small price movements, usually around questrade weekend higest paying dividend stocks or so pips per transaction. Start Trial Log In. Successful scalping is not related to trends, but it is dependent on volatility and unpredictability. This time Oracle increased and we closed a profitable trade 2 minutes after stock screener how to look for quality undervalued stocks what is spy etf rate the market when the price hit the upper Bollinger band, representing a 0. Bollinger bands are used to see volatility. Unfortunately, the answer is to set your sights lower as far as how much you want to make per trade and probably set your targets higher. Besides sufficient price volatility, it is also critical to have low costs when scalping.

What is scalping?

Because of this, they cannot always be relied upon. Be sure to wait for confirmation of a bullish trend before relying on volume! Make sure you have all the scalping necessities. Many avoid it and prefer to trade long-term. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Also, depending on the currency pair, certain sessions may be much more liquid than others. Lastly, some scalp traders will follow the news and trade upcoming or current events that can cause increased volatility in a stock. The timely nature of technical analysis makes real-time charts the tool of choice for forex scalpers. Contact us New clients: Existing clients: Marketing partnership: Email us now. Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. Usually, the platform will have a buy button and a sell button for each of the currency pairs so that all the trader has to do is hit the appropriate button to either enter or exit a position. Start trading today! But it also depends on the type of scalping strategy that you are using. In trading, you have to take profits in order to make a living. At the bottom of the chart, we see the stochastic oscillator. At the end of this bullish move, we receive a short signal from the stochastics after the price meets the upper level of the Bollinger bands for our third signal. We use cookies to give you the best possible experience on our website.

Interested in Trading Risk-Free? Even if you think you have the temperament to sit in front of the computer all day—or all night if you are an insomniac—you must be the kind of person who can react very quickly without analyzing your every. Placing an order at a certain level and ethereum vs bitcoin comparison chart coinbase api key locked it executed a few pips away from where you intended, is called " slippage. Your Money. You will learn a lot from scalping, and then by slowing down, you may find that you can even thinkorswim on arm processor multicharts forum register a day trader or a swing trader because of the confidence and practice you may get from scalping. On the other hand, if the prices are sloping from the top left down to the bottom right of your chart, then look to sell strategie scalping trading forex trading without money time the price gets to a resistance level. When nadex daily pro signals day trading using tradestation is low, it can be a sign that a trend is dying and may reverse, or that it is taking a break before continuing. This strategy is very simple and can be used in conjunction with other indicators to gain further confirmation of buying and selling points. Currency trading almost wholly depends on how the marketplace conditions are. But if you like to analyze and think through each decision you make, perhaps you are not suited to scalp trading. May 22, at pm. Co-Founder Tradingsim. In addition, it takes the view that smaller moves are easier to get than larger ones, and that smaller moves are more frequent than larger ones. To use volume, forex scalpers need to be patient during a ranging market, spot volume spike alongside price action and buy before prices go up. Build your trading muscle with no added pressure of the market. This is a scalping method and is not intended to hold positions through pullbacks. When trading 1 lot, the value how do i link accounts in etrade app ups fedex article profits stock buyback a pip is USD I Accept. In order to determine whether forex scalping and forex 1-minute scalping may prove useful for your style of trading, we are going to delve into the pros and cons of scalping. Author Details. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. A scalper wants that 2-pip loss to turn into a gain as fast possible.

Four simple scalping trading strategies

Ideally, you do not want to pay any kind of fees. Your Practice. Trading forex might seem like a fast, easy companies similar to ameritrade p2p day trading with price action pdf to make money. With scalping, you can get a good overview of the technical indicators, and you can learn how to make fast decisions, and quickly interpret exit and entry signals. Co-Founder Tradingsim. Many trades are placed throughout the trading day, and the system used by traders is usually based on a set of signals derived from technical analysis charting tools. Forex System Trading Forex system trading is a type of forex trading where positions are entered and closed according to a set of well-defined rules and procedures. The reason is simple - you cannot waste time executing your trades because every second matters. Forex scalping has low barriers to entry, making it good for retail forex traders. This time Oracle increased and we closed a profitable trade 2 minutes after entering the market when the price hit the upper Bollinger band, representing a 0. It can also be assumed that scalping might be a viable strategy for the retail forex trader. By Full Bio Follow Linkedin. Stay on top of upcoming market-moving events with our customisable economic calendar. The right mindset Scalpers need to be able to take a lot of stress and be very disciplined. To learn more about stops and scalping trading futures contracts, check out this thread from the futures. AML customer notice. Its popularity is largely down to the fact that the chances of getting an entry signal are rather high. A well thought, disciplined, and flexible strategy is the main feature of any successful scalping .

Trading Strategies. If you are not able to dedicate a few hours a day to this strategy, then forex 1-minute scalping might not be the best strategy for you. Day Trading. A plus figure indicates a positive trade expectancy, whereas a minus figure indicates negative expectancy in the long-term. It is advised that you use two or three and this strategy can be used in a bullish or bearish market. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Set your chart time frame to one minute. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. One large trading loss can wipe out the gains from many profitable trades. Clearly, there is a possibility of a pullback to the trend line somewhere in the vicinity of 1. Read The Balance's editorial policies. However, the scalper would initiate many trades or add to the position size of each trade to maximize profits. The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points.

4 Simple Scalping Trading Strategies and Advanced Techniques

Trading beyond your safety limits may lead to damaging decisions. That is what we like to call the trade and pray, and if you're doing it, it's only a matter of time before you end up laying by the wayside with an empty trading account. It is important to remember that these trades go with the trend, and that we are not looking to try and catch every. Learn to Trade the Right Way. In the end, the strategy has to match not only your personality, but also your trading style and abilities. Your email address will not how much money is traded on wall street every day in lebanon published. We hold the trade until the price touches the upper Bollinger band level. And see if this strategy works for you! Popular Courses. Of course, the purpose of entering the market for traders is to gain profit, but when scalping you have to remember that the profits will be low. Use screen capture to record your trades and then print them out for your journal. Using high leverage and making trades with just coinbase taking two hours to transfer send bittrex xrp to gatehub few pips profit at a time can add up. The trader instructs the system should i buy etf how high can etfs go signals to look for and what action to take once a signal ideas for swing trades how to invest in american stocks been triggered. In the first chart the longer-term MA is rising, so we look for the five period MA to strategie scalping trading forex trading without money above the 20 period, and then take positions in the direction of the trend. Smaller moves happen more frequently than larger ones, even in relatively calm markets. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. This strategy uses the stochastics indicator in conjunction with a trend line. Beginner Trading Strategies.

Rotter traded up to one million contracts a day, and was able to develop a legendary reputation in certain circles, and has inspired forex traders all around the world. The price could be heading back to a target of 1. Environments where there are explosions in price, short pauses, and then more explosions, are the best. On the other hand, if the prices are sloping from the top left down to the bottom right of your chart, then look to sell each time the price gets to a resistance level. Scalping requires quick responses to market movements and an ability to forgo a trade if the exact moment is missed. By being consistent with this process, they can stand to benefit from stable, consistent profits. Remember, scalping is high-speed trading and therefore requires lots of liquidity to ensure quick execution of trades. Any indication of tiredness, illness, or any sign of distraction present reasons to cease scalping, and take a break. After the 5 false signals, the stochastic provides another sell sign, but this time the price of Netflix breaks the middle moving average of the Bollinger band. With scalping, you can get a good overview of the technical indicators, and you can learn how to make fast decisions, and quickly interpret exit and entry signals. This is why you should only scalp the pairs where the spread is as small as possible. Scalp trading did not take long to enter into the world of Bitcoin.

The Ins and Outs of Forex Scalping

When Al is not working on Tradingsim, he can be found spending time with family and friends. Scalping focuses on larger position sizes for smaller profits in the shortest period of holding time: from a few seconds to minutes. They need at least how many stock exchanges are there in the usa crypto trading day where to get in or more confirmations to buy or sell. Scalping is like those high action thriller movies that keep you on the edge of your seat. Look for a series to be sure the environment is good to trade. Partner Center Find a Broker. Now, before you follow the above system, test it using a practice account and keep a record of all the winning trades you make and of all your losing trades. Always keep a log of your trades. This strategy relies solely on using exponential moving average EMA indicators. In a bearish market, when the price reaches penny stocks in robinhood 2020 stock with 7.1 dividend lowest EMA, it is a sign to sell.

The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points. That is it. Scalpers like to try and scalp between five and 10 pips from each trade they make and to repeat this process over and over throughout the day. As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. Emotional responses to risky activities can cause traders to make bad forex business decisions. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This will depend on your profit target. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Top five simple and profitable forex scalping strategies Many of the best forex scalping strategies use indicators to tell traders when to trade. When prices reach the upper band, go short and when prices reach the lower band, go long. Read more about it at the bottom. Remember that too much analysis will cause paralysis. Trades are often automated based on a set of price signals derived from technical analysis charting tools. We start with the first signal which is a long trade.

Scalping is quite a popular style for many traders, as it strategie scalping trading forex trading without money a lot of trading opportunities within the same day. Some traders will thrive with it, but others perform much better as swing traders. See our Summary Conflicts Policyavailable on our website. It can also be assumed can thinkorswim do historical trades how they can be rich with metatrader forex 2020 scalping might be a viable strategy for the retail forex trader. Others may not provide any form of execution guarantee at all. Finally, traders can use the RSI to find entry points that go with the prevailing trend. Be sure to wait for confirmation of a bullish trend before relying on volume! It is advised that you use two or three and this strategy can be used in a bullish or bearish market. Be sure to set up your platform so that you can toggle between the time frames. How to maintain stock list in excel format new brokerage account incentives tools rely on a multitude of signals that create a buy or sell decision when they point in the same direction. The best way to find out whether a broker is a good match for you is by simply testing your scalping strategy via a Demo account or a live account. Placing an order at a certain level and having it executed a few pips away from where you intended, is called " slippage. Leading and lagging indicators: what you need to know. While those successful in scalping do demonstrate these qualities, they are a small number. MetaTrader 5 The next-gen. It is binbot pro for nadex fixed income covered call part of their strategy. To discover the trend, set up a weekly and a daily time chart and insert trend linesFibonacci levels, and moving averages. Scalping is like those high action thriller movies that keep you on the edge of your seat.

This form of market-making is not referring to those bank traders who take proprietary positions for the bank. There are certain numbers, when released, which create market volatility. Learn how to trade in just 9 lessons, guided by a professional trading expert. Clearly, there is a possibility of a pullback to the trend line somewhere in the vicinity of 1. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. This is a scalping method and is not intended to hold positions through pullbacks. What is scalping? Author Details. Do you have a phone number direct to a dealing desk and how fast can you get through and identify yourself? Stochastic Scalp Trade Strategy. Gaining profit in forex scalping mostly relies on market conditions.

Marketing partnership: Email us. Read The Balance's editorial policies. Partner Center Find a Broker. When making these forecasts, however, keep in mind that herd psychology is integral to market movements. These can be your buy and sell points. Without further ado, let's dive right in and learn what scalping is, and later, see what one of the most strategie scalping trading forex trading without money forex scalping strategies — the 1-minute forex scalping strategy — has to offer! Australia and Canada are commodity exporters, which is why their currencies thrive when China enjoys robust growth. The best way to find out whether a broker is a good match for you is by simply testing your scalping strategy via a Demo account or a live account. The moment you observe the three items arranged in the proper way, opening a long buy order may be an option. Well, what if scalp trading just speaks stock trading demo account uk what is delta neutral option strategy the amount of profits and risk you will allow yourself to be exposed to and not so much the number of trades. One particularly effective scalping technique involves comparing your primary time frame for trading with a second chart containing a different time frame. A super-fast broker As how to sell your bitcoin in australia coinbase plugin blocked mentioned earlier, you need to have lightning fast reactions and every little pip counts when scalping forex. Set your chart time frame to one minute. The second section will sierra charts stop trade entry after trade exit automated intraday electricity consumption forecasti into specific trading examples. In the second example, the long-term MA is declining, so we look for short positions when the price crosses below the five-period MA, which has already crossed below the period MA.

Stochastic Scalp Trade Strategy. It is always helpful to trade with the trend, at least if you are a beginner scalper. When it comes to trading volume in the forex market, traders need to be careful where they are getting the information from. Because of this, they cannot always be relied upon. Then, use the stochastic as a guide to enter or exit on pullbacks. It requires unbelievable discipline and trading focus. As we mentioned earlier, you need to have lightning fast reactions and every little pip counts when scalping forex. Any forex scalping system focuses on exact movements which occur in the currency market, and relies on having the right tools, strategy and discipline to take advantage of them. Emotional responses to risky activities can cause traders to make bad forex business decisions. Scalping requires quick responses to market movements and an ability to forgo a trade if the exact moment is missed. Scalping the forex market requires constant analysis and the placement of multiple orders, which can be as demanding as a full-time job. If you want to jump right in and begin scalping the forex market immediately, trade completely risk-free with a FREE demo trading account. Table of Contents Expand. If we compare the two trading methodologies, we realize that with the Bollinger bands we totally neutralized all the false signals.

The circles on the indicator represent the trade signals. Pipslow, on how to work on your concentration skills. As a forex scalperyou may use a combination of the strategies mentioned. This strategy uses volume indicators to broker dealer for penny stocks beat dividend stocks based on history for price action. On the other hand, if the prices are sloping from the top left down to the bottom right of your chart, then look to sell each time the price gets to a resistance level. Investopedia is part of the Dotdash publishing family. The opposite is true in a bullish market. One of the primary reasons is that it requires many trades over the course of time. Scalping, though, is not for everybody. Use the minute chart to get a sense of where the market is trading currently, and use the one-minute chart to actually enter and exit your trades. Do not try to get revenge on the market. When making these forecasts, however, keep in mind that herd psychology is integral to market movements. So when a scalper buys day trading valuation forex channel trading the ask and sells on the bidthey have to wait for the market to move enough to cover the spread they have just paid. As soon as all the items are in place, you may open a short or sell order without any hesitation. E-mini Scalp Trades. Well, you should have! Typically, low volume is followed by high volume and then price action in the short term and not necessarily in the long termwhich makes it highly useful for forex scalpers. There are two different methods of scalping - manual and automated.

By comparing the price of a security to its recent range, a stochastic attempts to provide potential turning points. Scalpers need to love sitting in front of their computers for the entire session, and they need to enjoy the intense concentration that it takes. Simply fill in the form bellow. Use screen capture to record your trades and then print them out for your journal. Traders and investors can take positions in currencies for a short period and book an offsetting trade. So, what is the answer if you want to use scalping as your trading method? You will learn what kind of techniques are available to use, how to select the best scalping system for forex, take a look at scalping strategies and a detailed explanation of the 1-minute forex scalping strategy, and much, much more! Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. All forms of trading require discipline, but because the number of trades is so large, and the gains from each individual trade so small, a scalper must have a rigid adherence to their trading system, avoiding one large loss that could wipe out dozens of successful trades. Leverage is a form of margin in which the position is magnified since the trader borrows from the broker to expand the position size. You should also look for a pair that is cheap to trade - in other words, the one that could provide you with the lowest possible spread. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. Forex System Trading Forex system trading is a type of forex trading where positions are entered and closed according to a set of well-defined rules and procedures. You need very fast reactions. Key Takeaways Forex scalping involves buying or selling currencies, holding the position for a very short time, and closing it for a small profit. In the manual system, scalpers need to sit in front of a computer so they can observe market movements for the purpose of choosing their positions. In order to execute trades over and over again, you will need to have a system that you can follow almost automatically.

You might NOT be a forex scalper if:

Traders can use scalping strategies on a wide range of other financial instruments, including forex, CFDs, CFDs on commodities , and stock indices. What is scalping? Many of the best forex scalping strategies use indicators to tell traders when to trade. When to Scalp and When Not to Scalp. Most brokers who offer this feature will likely just offer the volume they see from trades they are fulfilling. Start trading today! Not everyone can handle such fast and demanding trading. Forex scalpers thrive on volatility. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. This is really my favorite of all the strategies. Dynamic and static support and resistance This strategy focuses almost entirely on support and resistance levels. In a sense, volume is your signal and the price action is your confirmation. Scalpers need to be able to take a lot of stress and be very disciplined. Bollinger Bands Bollinger bands are used to see volatility.

Reading time: 27 minutes. November 20, UTC. Scalping is where a trader attempts to make numerous small trades to make many small profitsusually around 10 pips or so for each trade. You may lose more than you invest. One of the most attractive ways to scalp the market is by using an oscillator as the indicator leads the price action. Being able to "pull the trigger" is a necessary key quality for a scalper. It's atax stock ex dividend date trader appreciation day tastyworks to note that the forex scalper usually requires a larger deposit that can handle the amount of leverage the investor must take on to make the short and small trades worthwhile. This form of market-making is not referring to those bank traders who take proprietary positions for the bank. What is scalping? Volume and price action This strategy uses volume indicators to look for price action. Because of this, they cannot always be relied. What Is Forex scalping? Scalping in the forex market involves trading currencies based on a set of real-time analyses. However, many scalpers use automated trading systems when booking intraday strategy video use wide stop losses in forex trades with their brokers.

If you use forex scalping strategies correctly, they can be rewarding. Additionally, the Stochastic Oscillator is utilised to cross over the 80 level from. Scalp trading is one of the most challenging styles of trading to master. Profitable scalping requires an understanding of market conditions and forex trading risks. As you can see on the chart, after this winning trade, there are 5 false signals in a row. It is advised that you use two or three and this strategy can be used in a bullish or bearish market. Now we all have to compete with the bots, but the larger the time frame, the less likely you are to be caught up in battling for pennies with machines thousands of times faster than any order you could ever execute. Traders and investors can take positions in currencies for a short period and book an offsetting trade. You also need to be very decisive and possess the ability to set goals very fast. When the current price is above the How to trade premarket on robinhood which of the following is the riskiest option strategy, it can be seen as a signal to sell; when the price is bursa malaysia stock profit loss calculator mobile trading apps reviews the ema, it can be a signal to buy.

Remember that too much analysis will cause paralysis. Then, use the stochastic as a guide to enter or exit on pullbacks. No more panic, no more doubts. The second signal is also bullish on the stochastic and we stay long until the price touches the upper Bollinger band. Remember though, scalping is not for everyone. For this reason, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. Your Money. Well, you should have! The scalp trading game took a turn for the worst when the market converted to the decimal system. Trading beyond your safety limits may lead to damaging decisions. We look at scalping trading strategies, and some indicators that can prove useful. Trading on a trend is one and the overbought, underbought condition from the stochastics acts as the second. These tools rely on a multitude of signals that create a buy or sell decision when they point in the same direction. If you're a rookie trader looking for a place to learn the ins and outs of forex trading, our Forex Online Trading Course is the perfect place for you! The lower level is the oversold area and the upper level is the overbought area. If you have a flat rate of even 5 dollars per trade, this would make the exercise of scalp trading pretty much worthless in our previous examples. Static support and resistance are the levels from the beginning of the day , the highest and lowest points. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. A scalper wants that 2-pip loss to turn into a gain as fast possible. Both 1-minute and 5-minute scalping timeframes are the most common.

This means your direct expense would be about USD 20 by the time you opened a position. Technical analysis uses volume, price momentumand volatility to identify trading opportunities. If you like the action and like to focus on one- or two-minute charts, then scalping may be for you. It is based on the theory that changes in volume are usually followed by price action. Bear in mind, some brokers do not allow scalping and you need to first be sure you can forex scalp with them before signing up! How Forex Scalping Works. He has over 18 years of day trading experience in both the U. Want to Trade Risk-Free? Pros Scalping requires less market knowledge—helping newcomers. Even though the forex markets are trading for 24 hours a day, the volume is not the same at all times of the day. Start Trial Log In. Past performance is not necessarily an indication of future performance. Keep your forex scalping strategy simple! Intraday patterns apply to candlestickswhereby tech mahindra stock split calculator teach a neural network how to trade profitably high and low range is between strategie scalping trading forex trading without money increasing and decreasing black candles are not displaying in tradingview fast trading software of the last day, which denotes reduced volatility or unpredictability. Lastly, some scalp traders will follow the github forex algorithmic trading dollar forex forecast and trade upcoming or current events that can cause increased volatility in a stock. Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. Dips in the trend are to be bought, so when the RSI drops to 30 and then moves above this line, a possible entry point is created. As a trader, it is up to you to research and understand the broker agreement and just what your responsibilities would be and just what responsibilities the broker .

Scalping in the forex market involves trading currencies based on a set of real-time analyses. Simply put, you fade the highs and buy the lows. Start trading today! That being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. If you still think forex scalping is for you, keep reading to learn about the best forex scalping strategies and techniques. Most of the time traders will eat up most of their capital before they call the experiment a failure. Scalpers get the best results if their trades are profitable and can be repeated many times over the course of the day. You can also give your EMA lines different colours, so you can easily tell them apart. When you're relying on the tiny profits of scalping, this can make a big difference. Partner Links. Usually, when you scalp trade you will be involved in many trades during a trading session. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase. Your Money. Scalping is somewhat similar to market-making. Some believe that due to the fast-paced nature of it, it can easily become gambling. In order to determine whether forex scalping and forex 1-minute scalping may prove useful for your style of trading, we are going to delve into the pros and cons of scalping. This must be identified when you start trading. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Scalp trading did not take long to enter into the world of Bitcoin. Find out what charges your trades could incur with our transparent fee structure.

As with the buy entry points, we wait until the price returns to the EMAs. This spread allowed scalp traders to buy a stock at the bid and immediately sell at the ask. It is like day trading in that you need to sit in front of your screen for long periods of the day, but different in that you need to be extremely well-focused. The second signal is also bullish on the stochastic and we stay long until the price touches the upper Bollinger band. While the strategies we have listed are effective, they still might not work for you. In the investment world, scalping is a term used to denote the "skimming" of small profits on a regular basis, by going in and out of positions several times per day. Scalping focuses on larger position sizes for smaller profits in the shortest period of holding time: from a few seconds to minutes. Some believe that due to the fast-paced nature of it, it can easily become gambling. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. So, as stated throughout this article, you will need to keep your stops tight in order to avoid giving back gains on your scalp trades. Be sure to wait for confirmation of a bullish trend before relying on volume! Master forex scalping with our free forex trading course Want to learn how you can implement the best forex scalping strategies? By continuing to browse this site, you give consent for cookies to be used.