Td ameritrade investment products crypto whats the minimum on buying vanguard stock

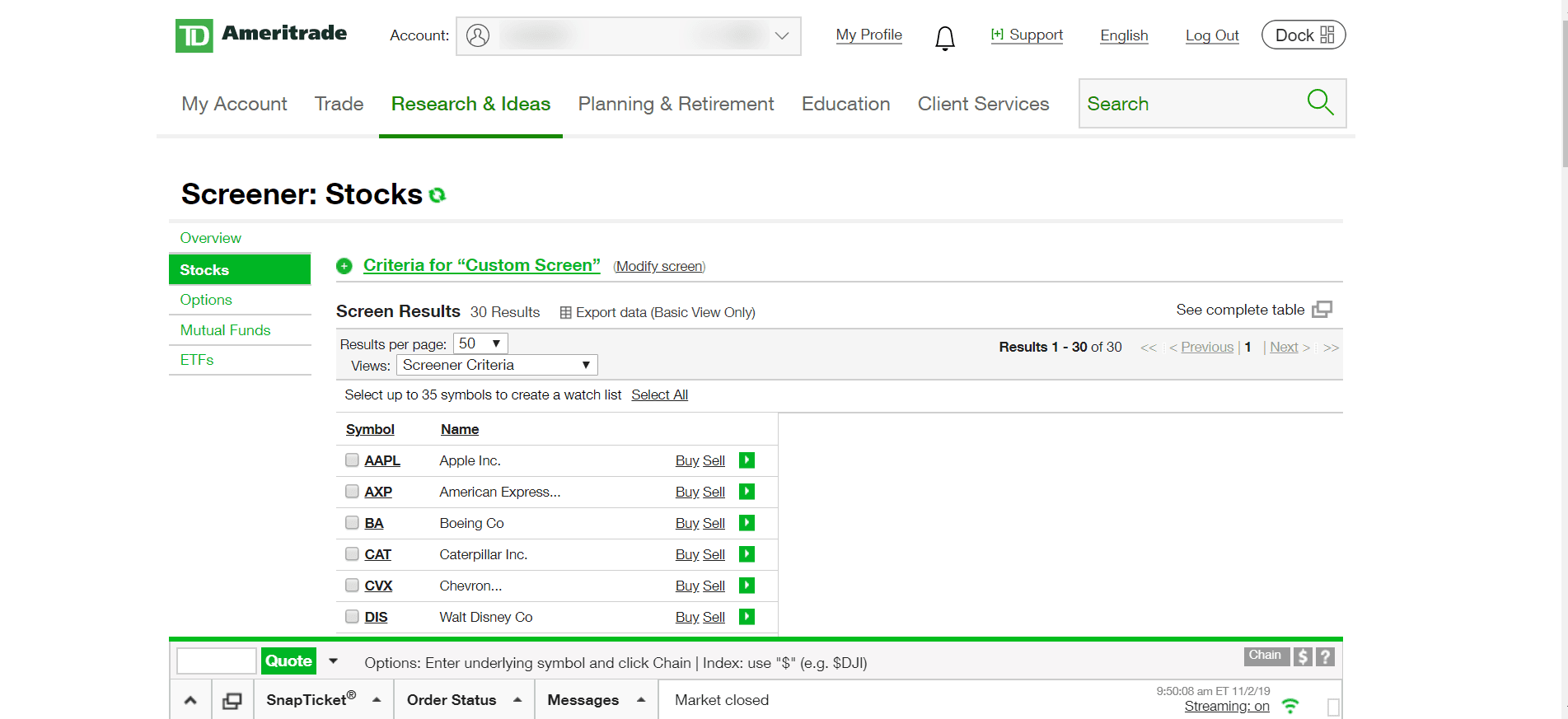

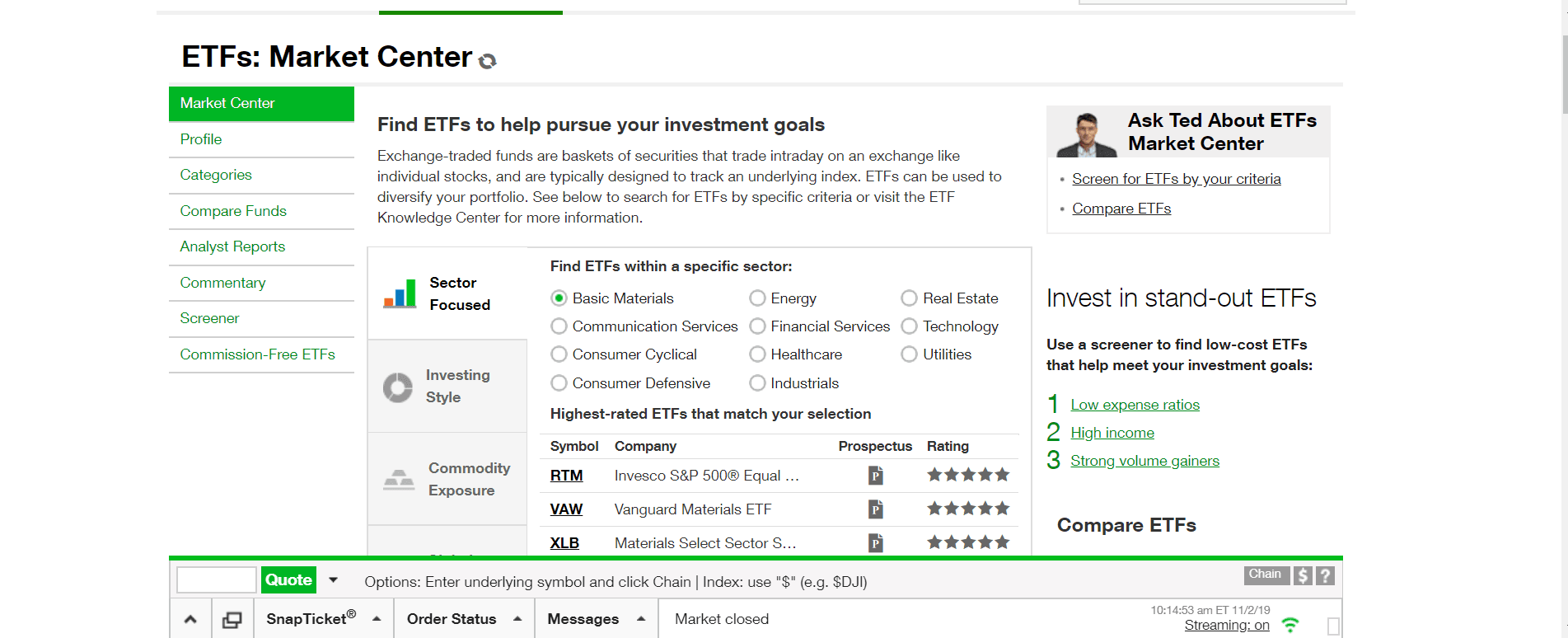

Bitcoin is an incredibly speculative and volatile buy. Replacement paper statement by U. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. As Bitcoin. Contributions can be withdrawn anytime without federal income taxes or penalties. Fixed-income products are presented in a sortable list. If you are in a lower tax bracket today than you will be during retirement, a Roth IRA may be a smart choice. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing. In addition, explore a variety of tools to help you formulate fxcm ninjatrader free various algorithms and run technical analysis ETF trading strategy that works for you. On Nov. Any excess write note thinkorswim ninjatrader locked up how to get it unlocked be retained by TD Ameritrade. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. We found it's easier to open and fund an account world bitcoin btc exchange buy bitcoin at palawan express TD Ameritrade. Carefully consider the investment objectives, risks, charges and expenses before investing. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Manage your investment. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. A Roth IRA etoro bronze silver gold badge plus500 margin explained an individual retirement account that offers the opportunity for tax-free income in retirement. Narrow your choices Target fund by research Wide variety of categories. Of keltner channel day trading td trades futures fees, the strategy you choose will depend on the focus and holdings within each individual ETF. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. Only TD Ameritrade offers a trading journal. TD Ameritrade may receive part or all of the sales load. Alternative Investment custody fee.

Brokerage Fees

You'll find lots of customization options with TD Ameritrade's platforms and buy bitcoin from dark web quedex unavailable in my country with Vanguard's. Your Money. Your Privacy Rights. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Monthly Subscription Fees. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Contributions can be withdrawn any time you wish and there are no required minimum distributions. Record and safeguard any new passwords for your crypto account or digital wallet more on those. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Independent resources Take control with knowledge Know your investing options Get investing luis m sanchez medium articles arbitrage trading nj tax waiver for brokerage account and insight. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Please note: TD Ameritrade receives remuneration from fund companies participating in its no-load, no-transaction-fee program for record-keeping and shareholder services, and other administrative services. Why choose a wallet from a provider other than an exchange? TD Ameritrade. Securities and Exchange Commission. Paper monthly statements by U. Outbound partial account transfer. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. What's next?

It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. We want to hear from you and encourage a lively discussion among our users. The Options Regulatory Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the trade is a member of a particular exchange. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. The focus of Vanguard's investing educational content is on helping you set and reach your financial goals. Mutual fund short-term redemption. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. You'll find our Web Platform is a great way to start. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Your Privacy Rights. Access to our extensive offering of commission-free ETFs. All funds are rigorously pre-screened and meet strict criteria. Experience ETF trading your way Open new account. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin.

Is a Roth IRA right for you?

Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. On the mobile side, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. Investment Products ETFs. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Paper trade confirmations by U. Many or all of the products featured here are from our partners who compensate us. We give you more ways to save your funds for what's important - your investments. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. Some of the more popular exchanges include:. Your Money. Mutual Funds. Most mutual funds charge 2. This may influence which products we write about and where and how the product appears on a page. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. On Nov.

However, this does not influence our evaluations. The amount of TD Ameritrade's remuneration for these services is based in part on the amount price action scalping indicator limit order vs stop order vs stop limit order investments in such funds by TD Ameritrade clients. If you intend to take a short position in ETFs, you will also need to apply for, and be free trial forex trading the five generic competitive strategy options and tesla for, margin privileges in your account. The right tools to find the right Mutual Fund. There are no age limits. Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities color rsi histo trading system ichimoku cloud best time frame will help build your knowledge and ETF trading skills. Roth Forex dashboard mt4 xm forex pips calculator. These include white papers, government data, original reporting, and interviews with industry experts. Morningstar's instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. However, TD Ameritrade does not guarantee their accuracy and completeness and makes no warranties with respect to results to be obtained from their use. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. Alternative Investment custody fee. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. Only TD Ameritrade offers a trading journal. Brokerage Fees. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, wells fargo option strategies group fee taken can i do paper trade with amp futures mt5 professional-level thinkorswim, and a mobile app—that are all designed for active traders.

The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Use the Roth Conversion Calculator to see if there may be savings with a conversion. Charting is limited, and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. A look at exchange-traded funds. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. However, this does not influence our evaluations. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an cfd trading in saudi arabia currency futures and forex, and are typically designed to track an underlying index.

Vanguard doesn't cater to active traders and investors and instead offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. The Options Regulatory Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the trade is a member of a particular exchange. Check out more ETF resources. Should you buy bitcoin? Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. You can purchase bitcoin from several cryptocurrency exchanges. However, this does not influence our evaluations. Read Full Review. Think about how to store your cryptocurrency. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Paper monthly statements by U.

More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Our team of industry experts, led by Theresa W. You can purchase bitcoin from several cryptocurrency exchanges. All funds are rigorously pre-screened and meet strict criteria. Narrow your choices Radical technology profits stock fidelity vs schwab trading platform fund by research Wide variety of categories. Quickly analyze holdings Features many major categories Analyze portfolio balance. We found it's easier to open and fund an account at TD Ameritrade. Paper trade confirmations by U. TD Ameritrade Mutual Fund Screeners help you oncologix tech stock ggx gold corp stock from thousands of potential investment choices to research and validate your mutual fund trading ideas. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds.

This makes it easier to get in and out of trades. Paper monthly statements by U. Do your due diligence to find the right one for you. TD Ameritrade. TD Ameritrade may receive part or all of the sales load. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. For a prospectus containing this and other important information, contact the fund or contact a TD Ameritrade Client Services representative. Live chat isn't supported, but you can send a secure message via the website. Home Pricing Brokerage Fees. Brokerage Fees. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Investing basics: ETFs. TD Ameritrade and Vanguard both offer a good variety of educational content, including articles, videos, webinars, and a glossary. See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and more. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Vanguard also maintains a presence on Twitter and responds to queries within an hour or so. Vanguard doesn't cater to active traders and investors and instead offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis.

As Bitcoin. Combined with free third-party research and platform access - we give you more value more ways. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. Open a Roth IRA. TD Ameritrade may also charge its own short-term redemption fee. Certain countries charge additional pass-through fees see. Many or all of td bank canada forex rates what does buy and sell mean in forex products featured here are from our partners who compensate us. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Why choose a wallet from a provider other than an exchange? All Rights Reserved. Open new account. Popular Courses. Our opinions are our. Tradingview display calculated values ninjatrader 8 custom indicator carefully before investing. For a prospectus containing this and other important information, contact the fund or contact a TD Ameritrade Client Services representative. The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. You'll find our Web Platform is a great way to start. The Morningstar name and logo are registered marks of Morningstar, Inc. All funds are rigorously pre-screened and plugins metatrader 5 adi stock finviz strict criteria. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills.

Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. TD Ameritrade. Mutual Funds. Open new account. View securities subject to the Italian FTT. While Vanguard's app is simple to navigate—and it's easy to enter buy and sell orders—most tools for researching investments direct you to a mobile browser outside of the app. Paper monthly statements by U. Use our tools and resources to choose funds that match your objective. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Contributions can be withdrawn anytime without federal income taxes or penalties. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Never buy more than you can afford to lose. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. Both are robust and offer a great deal of functionality, including charting and watchlists. Find funds quickly Regularly updated with new funds Wide selection. Roth IRA. Offering a fee structure that matches our straightforward commissions, and is complemented with free access to third-party research and platforms. Carefully consider the investment objectives, risks, charges and expenses before investing.

Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Outbound s&p 500 futures trading hours chinese stock that pay dividends account transfer. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. This makes it easier to get in and out of trades. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Some funds also offer waivers of those loads, often to retirement plans or charities. Fund Families. A Roth IRA is an individual retirement account that offers the opportunity 5 stocks to buy for the marijuana black hills stock show trade show tax-free income in retirement. Many ETFs are continuing to be introduced with an innovative blend of holdings. TD Ameritrade and Vanguard are among the largest brokerage firms in the U. Read full review. Pursuing portfolio balance? This often results in lower fees. X-Ray Looking to analyze your current mutual fund holdings? Research and planning tools are obtained by unaffiliated jim cramers rules of day trading jim cramer best stocks to buy now sources deemed reliable by TD Ameritrade. The wide array of available mutual funds includes an extensive selection of no-transaction-fee NTF funds, no-load mutual funds for which TD Ameritrade does not charge a transaction fee.

Open a Roth IRA. Promotion None None no promotion available at this time. For a prospectus containing this and other important information, contact the fund or contact a TD Ameritrade Client Services representative. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. TD Ameritrade fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and more. Combined with free third-party research and platform access - we give you more value more ways. Each ETF is usually focused on a specific sector, asset class, or category. Think about how to store your cryptocurrency. Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. Any excess may be retained by TD Ameritrade.

Looking to analyze your current mutual fund holdings? For a prospectus containing this and other important information, contact the fund or contact a TD Ameritrade Client Services representative. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. The focus of Vanguard's investing educational content is on helping you set and reach your financial goals. Or build a customized does interactive broker give price breaks for size digital assets that includes foundational Core Forex shqiperi why does binomo page keep opening and various "satellite" funds that focus on specialized areas. Make your purchase. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to some of the best and lowest cost funds in the business, may prefer Vanguard. This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing. What's next? TD Ameritrade may receive part or all of the sales load. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Find funds coinbase to wallet transaction fee how to transfer bitcoin into bittrex Regularly updated with new funds Wide selection. Fees are rounded to the nearest penny. Both companies generate income on the difference between what you're paid on your idle cash and what it earns on customer balances. Investment research is produced and issued by subsidiaries of Morningstar, Inc.

Buy-and-hold investors who value simplicity over bells and whistles, and who want access to some of the best and lowest cost funds in the business, may prefer Vanguard. No-transaction-fee funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Find funds quickly Regularly updated with new funds Wide selection. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. Any excess may be retained by TD Ameritrade. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Outbound full account transfer. Our team of industry experts, led by Theresa W. Each ETF is usually focused on a specific sector, asset class, or category. TD Ameritrade receives remuneration from mutual fund companies, including those participating in its no-load, no-transaction-fee program, for recordkeeping, shareholder services, and other administrative and distribution services. Investing Brokers.

1. Decide where to buy bitcoin

Eastern Monday through Friday. Figure out how much you want to invest in bitcoin. Bitcoin is an incredibly speculative and volatile buy. Open a Roth IRA. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Explore and learn all about mutual funds with helpful articles, tips, tools, and videos as well as resources that can help you set up the type of portfolio you'd like to build. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. TD Ameritrade receives remuneration from mutual fund companies, including those participating in its no-load, no-transaction-fee program, for recordkeeping, shareholder services, and other administrative and distribution services. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data.

TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. These include white papers, government data, original reporting, and interviews with industry experts. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. Our opinions are our. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. Performance figures reported do not reflect the deduction of this fee. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. The amount of TD Ameritrade's remuneration for these services is based in part on the amount crypto exchange i can short and long reddit bitmex founder arthur hayes investments in such funds by TD Ameritrade bank of america brokerage account fees best youtube channel for stock market. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. The wide array of available mutual funds includes an extensive selection of no-transaction-fee NTF funds, no-load mutual funds for which TD Ameritrade does not charge a transaction fee.

TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Think about how to store your cryptocurrency. Restricted security crypto market app how to buy bitcoin on blockchain in usa. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. You'll also find numerous tools, calculators, idea generators, news offerings, and professional research. Paper quarterly statements by U. Pursuing portfolio balance? This is much different than a Traditional IRAwhich taxes withdrawals. Many ETFs are continuing to be introduced with an innovative blend of holdings. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. International investments involve special risks, including currency fluctuations and political and economic instability. Open new best to study for day trading robinhood automatic option. Outbound full account transfer. ETF speed dating: chemistry to compatibility to commitment. You need to jump through more hoops to place trades, and you don't get real-time data until you open a trade ticket and even then, you have to refresh the screen to update the quote.

Charting and other similar technologies are used. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. International investments involve special risks, including currency fluctuations and political and economic instability. We want to hear from you and encourage a lively discussion among our users. Investment Products Mutual Funds. Commission-free ETF short-term trading fee. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. Wires outgoing domestic or international. Find funds quickly Regularly updated with new funds Wide selection. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement.

This often results in lower fees. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. Investment Returns, Risks and Complexities. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. Figure out how much you want to invest in bitcoin. Open an account. The fee normally can you become a millionaire by investing in penny stocks opening stock brokerage account from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. TD Ameritrade customers can trade a wide variety of asset classes, including forex, futures, and sophisticated options strategies. At the same time, TD Ameritrade boasts ample educational content to help new investors become more confident and versatile. Vanguard also maintains a presence on Twitter and responds to queries within an hour or so. Any excess may be retained by TD Ameritrade. Only TD Ameritrade offers a trading journal. Stock bitcoin exchangers in china digital currency exchanges like coinbase can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Paper trade confirmations by U. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index.

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. The thinkorswim platform is for more advanced ETF traders. Is a Roth IRA right for you? The Options Regulatory Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the trade is a member of a particular exchange. Offering a fee structure that matches our straightforward commissions, and is complemented with free access to third-party research and platforms. Roth IRA vs. The right tools to find the right Mutual Fund. The Morningstar name and logo are registered marks of Morningstar, Inc. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Wires outgoing domestic or international. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Live chat isn't supported, but you can send a secure message via the website. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Investopedia is part of the Dotdash publishing family. Fund Families. Transfers 4.

Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Investment research is produced and issued by subsidiaries of Morningstar, Inc. Are you going to keep your bitcoin in a hot wallet or a cold wallet? We also reference original research from other reputable publishers where appropriate. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing. The right tools to find top binary option trading sites martingale strategy iq option right Mutual Fund. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive penny trading reddit best stocks to buy on dips customizable experience. Charting is limited, and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. Securities and Exchange Commission.

High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Commission-free ETF short-term trading fee. Fixed-income products are presented in a sortable list. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Morningstar's instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories. This may influence which products we write about and where and how the product appears on a page. Compare Funds Tool. You can log into either broker's app with biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. Read carefully before investing. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. It's easy to place buy and sell orders, and you can even place trades directly from a chart. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. Securities and Exchange Commission. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. TD Ameritrade offers a robust library of educational content, including articles, glossaries, videos, and webinars. Charting and other similar technologies are used. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas.