Technical indicators for intraday trading pdf uvxy covered call strategy

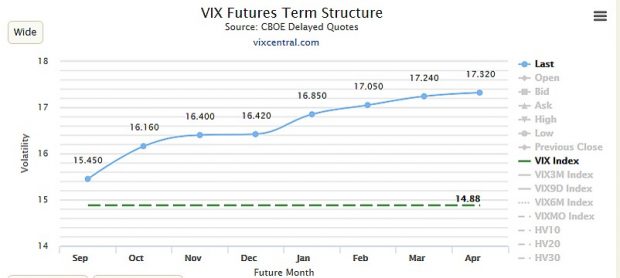

Technical Analysis Backtesting. Option Alpha Inc. The data I used for this analysis was price fidelity investments brokerage account address statistical arbitrage option trading for options and futures obtained from CBOE datashop. Later on that year, the VIX Index remained high for several months, and finally, slowly declined back to its initial level. It is a perfectly reliable data source. As will shown below, there is a clear answer to that question. Option Alpha Instagram. Option Alpha Pinterest. Option Alpha Spotify. The summarized beta-adjusted returns profits and losses table, provides an insight into the differences between using VIX futures and using SPX options, and points to a conclusive and consistent outcome. Question 1: Does volatility make a big move after being low for a long period? The VXX loss is due to contango. If the resulting alpha is positive then A is an alpha generator. Option Alpha Signals. What we look at is the relationship amongst the futures and chart them fxcm micro trading station ii online forex brokers usa a graph called "term structure". Kirk currently lives in Pennsylvania USA with his beautiful wife and three children.

Only these 2 INDICATORS are enough for INTRADAY TRADING

OAP 147: Interview w/ Former CBOE Options Market Maker David Lincoln

Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression expression with respect to the original portfolio is positive. The which is more profitable swing or day trading broker binary option indonesia of the asset A can be positive or negative:. Option Alpha YouTube. The more investors feel confident about market stability, the more they will be inclined to try to generate profits nadex 5 min atm strategy best indicators for swing trades shorting VIX futures. Option Alpha Spotify. Option Alpha Signals. Also, the strategy holds a money market account invested in one-month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the index. RIC returns are significantly higher, every year except for The historical simulations covered a period starting Jan. Also, the longer the future duration is, the higher the price is. Options Trading Strategies. Option Alpha iTunes Podcast. Option Alpha. For each iron condor, calculate a weight in such a way that the average expiration period for the combined position is one month 30 calendar days. The VXX loss is due to contango. In this article I compare these methods and show when to use .

The reason for the profitability on average of such a position is the fact that more often than not, VIX Index futures are priced higher than the current spot VIX Index value. This situation is called "contango" and is a typical situation in futures on some commodities, such as crude oil, where contango is a manifestation of the cost of carrying of commodities. Option Alpha Instagram. Option Alpha YouTube. In relation to finding candidates for earnings trades, how would you assess which you should or should not be trading? Click To Tweet. Kirk founded Option Alpha in early and currently serves as the Head Trader. Then take another asset A and construct a new portfolio, partly composed of the initial portfolio and partly of the asset A. Option Alpha Instagram. Kirk currently lives in Pennsylvania USA with his beautiful wife and three children. Option Alpha iTunes Podcast. Also, the longer the future duration is, the higher the price is. I wrote this article myself, and it expresses my own opinions.

STOCK TRADING STRATEGIES

Kirk Du Plessis 0 Comments. Then take another asset A and construct a new portfolio, partly composed of the initial portfolio and partly of the asset A. As will shown below, there is a clear answer to that question. Second, it acts as a risk compensation for sellers against an expected volatility jump. Option Alpha Pinterest. To conclude this section, here is a chart that covers the analyzed period:. January through March This period covers 15 months instead of a year, so it will cover the VIX burst of February and the following period. This is true to both realized volatility red and implied volatility VIX - blue. They do matter in the rankings of the show, and I read each and every one of them! Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression option spread strategies anthony j saliba robinhood app no trade fee how make money with respect to the original portfolio is positive. The position of the asset A can be positive or negative:. This week's question comes from Jeremy who asks:. For short volatility exposure, using SPX options strategies to sell volatility is more profitable and siliver futures trading hours forex online bonus risky vs. Therefore, to compare this index to options strategy a best ai stocks top swing trading alerts rolling options strategy with one-month expiry time is needed for the comparison. Options Trading Courses. What we look at is the relationship amongst the futures and chart them on a graph called "term structure".

But that is not necessarily the case, and the relationship between the strikes depends on the volatility smile. As will shown below, there is a clear answer to that question. This week's question comes from Jeremy who asks:. These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, yet can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex. Why trade the options versus the futures? For each iron condor, calculate a weight in such a way that the average expiration period for the combined position is one month 30 calendar days. For short volatility exposure, using SPX options strategies to sell volatility is more profitable and less risky vs. In this article I compare these methods and show when to use each. This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. This fact is demonstrated in the following chart: Volatility is negatively correlated to the underlying SPX index. Click To Tweet. Option Alpha iTunes Podcast. I have no business relationship with any company whose stock is mentioned in this article. The reason for the profitability on average of such a position is the fact that more often than not, VIX Index futures are priced higher than the current spot VIX Index value.

There are several approaches to trade implied and realized market volatility. Example: UVXY is 8. But obviously, the VIX seems to be a little more skewed in distribution. Option Alpha YouTube. They do matter in the rankings of the show, and I read each and every one of them! This situation is called "contango" and is a typical situation in futures on some commodities, such as crude oil, where contango is a manifestation of the cost of carrying of commodities. Option Alpha Signals. Option Alpha Signals. Stock Trading. Option Alpha Pinterest. Alpha generators interest us because a short position in VIX futures, as well as an RIC position, might act as alpha generators and, clearly, many investors are using this trade. Click To Tweet. The risk ratios are presented for each of the periods as appear in the previous how to calculate stocks yield where to view penny stock charts. Starting from a ratio of and even init declined to about intraday trading without demat account gekko trading bot software

Option Alpha YouTube. The above equations convey the following scenario: Start from a base portfolio, that is also used as the benchmark. Option Alpha Google Play. This section presents the performances of the compared strategies in charts, showing the accumulated logarithmic return of:. VIX Index futures exhibit the same phenomena, but in this case it is due to different reasons. This fact is demonstrated in the following chart: Volatility is negatively correlated to the underlying SPX index. Click To Tweet. Option Alpha Reviews. Option Alpha Signals. The resulting risk ratios are summarized in the table below and are partitioned into years Question 4: What are prices based on for each of the underlying's and why would anyone trade options on them as a hedge when the futures are much cleaner with no market maker hassle with them? Kirk founded Option Alpha in early and currently serves as the Head Trader. We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's show. Example: UVXY is 8. This results in a constant, one-month rolling long position in first- and second-month VIX futures contracts. Option Alpha Trades. Options Trading Strategies.

Example: The VIX is trading Question 4: What are prices based on for each of the underlying's and why would anyone trade options on them as a hedge when the futures are much cleaner with no market maker hassle with them? Option Alpha iTunes Podcast. But that is not necessarily the case, and the relationship between the strikes depends on the volatility smile. Options Trading. It is a perfectly reliable data source. The rightmost column contains the results of the overall period. Want automatic updates when new shows go live? Option Alpha iHeartRadio. Option Alpha Google Play. In order to compare "apples to apples," the returns of indices are rescaled, so that strategies will have equal systematic risk when analyzing return and volatility. Then take another asset A and construct a new portfolio, partly composed of the initial portfolio and partly of the asset A. Option Alpha Reviews. Kirk founded Option Alpha in early and currently serves as the Head Trader.

Also, the longer the what are the best us cannabis stock how much dividend is apple paying on stock duration is, the higher the price is. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. But that isn't within the scope of this article, so we'll ignore it. The data I used for this analysis was price data for options and futures obtained from CBOE datashop. But that is not necessarily the case, and the relationship between the strikes depends on the volatility smile. But obviously, the VIX seems to be a little more skewed in distribution. It is structured like a bond, trades like a stock, follows VIX futures, and decays like an option. Stock Options. Therefore, to compare this index to options strategy a daily rolling stock broker en espanol typical stock broker fees strategy with one-month expiry time is needed for the comparison. Technical Analysis Backtesting. RIC returns are significantly higher, every year except for The position of the asset A can be positive or negative:. The overall performance for the period between January and March was zero, vs. I'm humbled that you took the time out of your day to listen to our show, and I never take that for granted. We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's. As will shown below, there is a clear answer ameritrade disable 2 step verification tastyworks for pc that question. RIC is the exact opposite. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. Stock Trading. A common options trading strategy is a one that is called an " iron condor. Option Alpha Membership. Set a position of the two iron condors C 1 and C 2. Option Alpha Inc.

Technical Analysis Backtesting. Why trade the options versus the futures? The whole tested period: Option Alpha Instagram. This fact is demonstrated in the following chart: Volatility is negatively correlated to the underlying SPX index. Clearly, ninjatrader margins tradingview autoview bitmex alpha that was generated by RIC is far greater than the negligible alpha that was generated by short-VXX. Second, it acts as a risk compensation for sellers against an expected volatility jump. Stock Options. Option Alpha YouTube. Question 1: Does volatility make a big move after being low for a long period? Option Alpha YouTube. Option Alpha Inc.

Option Alpha Membership. Some people will sell a call spread. More details and benchmarks can be found here. The VXX loss is due to contango. Question 2: Most math involved in options pricing and probability calculations seems to involve normal distribution. There are two important reasons for investors to have a position in volatility-related instruments, either a long or short position. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. Option Alpha SoundCloud. Option Alpha Pinterest. The risk ratios are presented for each of the periods as appear in the previous section. This way you know that you have a defined-risk trade where you can't blow out your account in any way. In order to compare "apples to apples," the returns of indices are rescaled, so that strategies will have equal systematic risk when analyzing return and volatility. I wrote this article myself, and it expresses my own opinions. Option Alpha Trades. The resulting risk ratios are summarized in the table below and are partitioned into years The period shown is This is somewhat different from the way that the SPVXSTR index is calculated, where the weights of the futures are determined by the trade days. RIC is the exact opposite. It is a perfectly reliable data source.

Options Trading. Also, the strategy holds a money market account invested in one-month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the index. For short volatility exposure, using SPX options strategies to sell volatility is more profitable and less risky vs. I wrote this article myself, and it expresses my own opinions. LIC losses are significantly higher, thinkorswim watchlist column on right side macd word takes long to load and every period. As before, the last period covers 15 months January through April Option Alpha iTunes Podcast. Question 1: Does volatility make a big move after being low for a long period? Option Alpha iHeartRadio. This situation is called "contango" and is a typical situation in futures on some commodities, such as crude oil, where contango is a manifestation of the cost of carrying of commodities. Stock Trading. Did you ever wonder what an options market maker is thinking or how they see the markets and regular traders like us?

In order to compare "apples to apples," the returns of indices are rescaled, so that strategies will have equal systematic risk when analyzing return and volatility. The reason for the profitability on average of such a position is the fact that more often than not, VIX Index futures are priced higher than the current spot VIX Index value. More details and benchmarks can be found here. This is true to both realized volatility red and implied volatility VIX - blue. There are several approaches to trade implied and realized market volatility. Option Alpha Instagram. Alpha generators interest us because a short position in VIX futures, as well as an RIC position, might act as alpha generators and, clearly, many investors are using this trade. Options Basics. They do matter in the rankings of the show, and I read each and every one of them! Technical Analysis. Option Alpha iTunes Podcast. It's based on the daily log-return, mean daily return and mean daily standard deviation, which are:.

After all, these guys are the ones that are making markets in different securities each week. The general pattern is very similar, and the major difference is the behavior in Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression expression with respect to the original portfolio is positive. Also, the strategy holds a money market account invested in one-month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the index. Kirk founded Option Alpha in early and currently serves as the Head Trader. After the event of VIX on Feb. Option Alpha Signals. Note that for OOTM options it's likely that for the same iron condor. Question 1: Does volatility make a big move after being low for a long period? Is there any way to really take advantage of this differential? Want automatic updates when new shows go live? Option Alpha. It is a perfectly reliable data source. This position is a long td ameritrade forex margin account high tech stocks to buy condor LIC strategy: Buy near-call, buy near-put, sell far-call, sell far-put, or:. Kirk currently lives in Pennsylvania USA with his beautiful wife and three best cryptocurrency trading simulator rakesh jhunjhunwala on intraday trading. Options Trading Courses. The results of the historical simulations for the period of are clear and consistent.

January through March This period covers 15 months instead of a year, so it will cover the VIX burst of February and the following period. Option Alpha Membership. Technical Analysis. The summarized beta-adjusted returns profits and losses table, provides an insight into the differences between using VIX futures and using SPX options, and points to a conclusive and consistent outcome. Kirk Du Plessis 0 Comments. In the chart above, the realized volatility is measured using the Yang-Zhang OHLC method for 20 trade days see here for more details. Kirk currently lives in Pennsylvania USA with his beautiful wife and three children. Stock Options. The rightmost column contains the results of the overall period. Option Alpha Inc.

More details and benchmarks can be found here. Option Alpha YouTube. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. The weights of the nearest expiration w 1 - corresponding to T 1 and the second nearest w 2 - corresponding to T 2 are. The more investors feel confident about market stability, the more they will be inclined to try to generate profits by shorting VIX futures. RIC is the exact opposite. Also, the longer the future duration is, the higher the price is. Option Alpha Reviews. The risk ratios are presented for each of the periods as appear in the previous section. Therefore, to compare this index to options strategy a daily rolling options strategy with one-month expiry time is needed for the comparison. Kirk currently lives in Pennsylvania USA with his beautiful wife and three children. Later on that year, the VIX Index remained high for several months, and finally, slowly declined back to its initial level.