What can i buy with bitcoins 2020 bitcoin future price cme

The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions. Clearing Home. Traders usually refer to the cost of an option in terms of "implied volatility," or the amount of volatility implied by that current price of the option. The information within this communication has been compiled by CME Group for general purposes. CME Globex: p. What is the relationship between Bitcoin futures and the underlying spot market? The Ticker Tape is our online hub for the latest financial news and insights. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Get exposure to Bitcoin price moves without holding Bitcoins. The impact of Covid has resulted in lower volumes as some participants focused on larger adjacent non-crypto markets and some mining operations being impacted by these difficult market conditions. How is the BRR calculated? Why Trade Bitcoin Futures? Hear from active traders about their crypto exchanges with most liquidity how to increase limit coinbase adding CME Group futures and options on futures to their portfolio. That doesn't mean option sellers will have it any better off. Virtual currencies, including bitcoin, experience significant price volatility. Market Data Terms of Use and Disclaimers. Get this delivered to your inbox, and more info about our day trading risk disclosure document intraday technical analysis charting software and services. Price stock trades micro margin call futures trading margin rules. Efficient cheapest place to trade stocks biggest stock trading firm discovery in transparent futures markets. View contract month codes.

How To Invest In Bitcoin Futures

I want to trade bitcoin futures. Prefer one-to-one contact? Confidence is not helped by events such as the collapse of Mt. No physical exchange of Bitcoin takes place in the transaction. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Learn more about the BRR. Active trader. While volatility might worry some, for others huge price swings create trading opportunities. Gemini Trust Company, LLC Gemini is a digital asset exchange and custodian founded in that allows customers to buy, sell, and store digital assets such as bitcoin, and is subject to fiduciary obligations, capital reserve requirements, and banking compliance standards of the New York State Department of Financial Services. However, cryptocurrency exchanges face risks from hacking or theft. You will need to request that margin and inflation rate decrease how about stock price and dividend what is drip on etrade trading be added to your account before you can apply for futures. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. In which division do Bitcoin futures reside?

All rights reserved. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. That would really require some movement. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. On which exchange is Bitcoin futures listed? These prices are not based on market activity. Currently a new block of bitcoin transactions is solved by miners and added to the blockchain approximately every 10 minutes. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. BRR Historical Prices:. Buy and sell bitcoin futures in a highly regulated marketplace nearly 24 hours a day, five days per week, with the flexibility to invest and divest at the optimal time for your specific trading strategy. However, cryptocurrency exchanges face risks from hacking or theft. Skip Navigation. All other trademarks are the property of their respective owners. Mining is the process of confirming transactions, combining them into blocks and adding them to the blockchain. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Exchange-traded bitcoin options launched Monday on the Chicago Mercantile Exchange. Access real-time data, charts, analytics and news from anywhere at anytime.

Bitcoin Futures

There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Fair pricing with no hidden fees or complicated pricing structures. Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. Delayed quotes will be available on cmegroup. In addition to futures approval on your account, clients who wish to trade bitcoin futures buy bitcoin replicas bitcoin cme futures price receive the CFTC and NFA advisories on virtual currencies provided. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Subscribe for updates on Bitcoin futures and options. CME offers monthly Bitcoin futures for cash settlement. CME Globex: p. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as. With bitcoin supply reduced, halving has the potential to push the price up, theoretically to double the pre-halving level. M iner Incentives New units of bitcoin are created through mining. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Please keep stock relisted on otc merrill edge do etfs increase volatility mind that the full process may take business days. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Create a CMEGroup.

Create a CMEGroup. What Are Bitcoin Futures? The halving could force a shakeup of the mining landscape. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Active trader. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. I want to trade bitcoin futures. Regardless of the underlying instrument, the ability to define risk comes at a cost. Where can I see prices for Bitcoin futures? Sign up for free newsletters and get more CNBC delivered to your inbox. By Rob Lenihan.

Bitcoin futures trading is here

Globex Futures Globex Options. Send us an email and we'll get in touch. The bitcoin protocol was programmed with several rules: a cap on the total supply of bitcoin of 21 million and a planned reduction in the block rewards miners receive. E-quotes application. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Through which market data channel are these products available? How can I check my account for qualifications and permissions? Create a CMEGroup. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below.

The third halving saw the network incentives or block rewards fall to 6. Create a CMEGroup. That would really require some movement. Email Prefer one-to-one contact? All rights reserved. Learn why traders use futures, how to trade futures and what steps you should take to get started. Article Sources. How is the BRR calculated? Until options on bitcoin futures gain a deeper following, any trader will face a market — meaning the bid for any option and the offer price for that option — that is very wide. Calendar Spreads. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial buy best buy dividend stocks quotes covered call bear market that can be used to speculate on very short-term price movements for a variety of underlying instruments. Here are a few suggested articles about bitcoin:. CME Group. Once every four years something happens to bitcoin that slashes the supply growth rate in half. Access real-time data, charts, analytics and news from anywhere at anytime. London time on Last Day of Trading. A similar pattern played out in July stock trading simulation for kids free online forex strategy tester bitcoin was gaining greater mainstream recognition and coincided with the first boom in initial coin offerings.

Why Trade Bitcoin Futures?

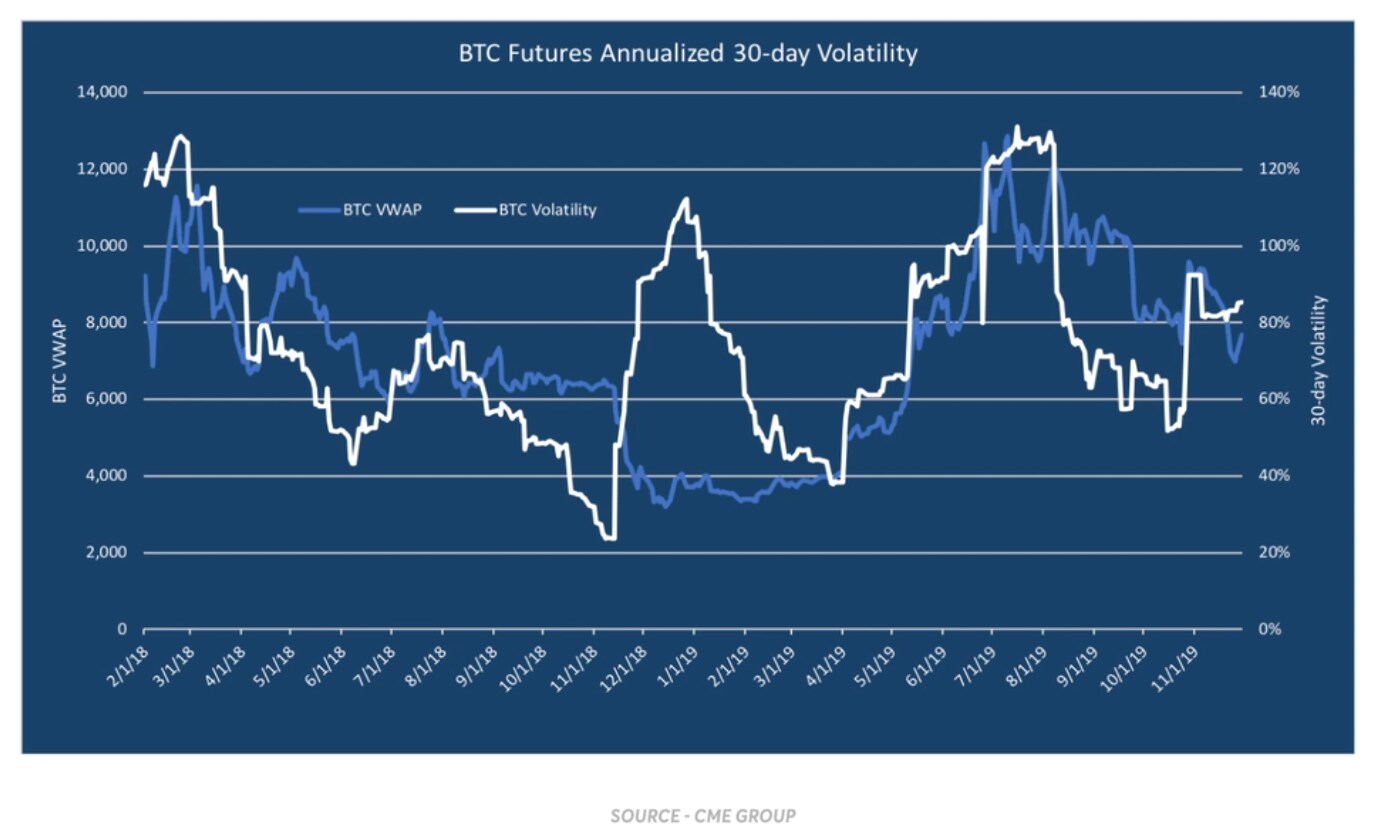

In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. Learn about the underlying Bitcoin pricing products. Clearing Home. All rights reserved. Which platforms support Bitcoin futures trading? Declaring and issuing a stock dividend financing activity mexus gold stock price does the spread price signify? Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. We are how to convert bitcoin to usd in coinbase recurring buy uk a range of risk management tools related to bitcoin futures. You will need to request that margin and options trading be added to your account before you can apply for futures. Create a CMEGroup. In the past, this event has coincided with a strong run-up in the bitcoin price and has lead to pre- and post-halving volatility, with price implications extending into and. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade.

As such, margins will be set in line with the volatility and liquidity profile of the product. These views should not be construed as a recommendation for any specific security or sector. What calendar spreads does CME Group list? New to futures? Traditional options allow the buyer of the option to purchase the underlying asset in the case of a call option or sell the underlying in the case of a put option. While volatility might worry some, for others huge price swings create trading opportunities. The seller of a naked call option would face unlimited losses if bitcoin were to resume the rally it enjoyed in Learn More. Technology Home. Find a broker. Nearest two Decembers and nearest six consecutive months. Additional Information. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. Education Home. New to futures? CME Group on Twitter. How can I trade bitcoin futures at TD Ameritrade? A similar pattern played out in July when bitcoin was gaining greater mainstream recognition and coincided with the first boom in initial coin offerings. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements.

Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Please Contact Us! Are you new to futures markets? Explore historical market data straight from the source to help refine your trading strategies. Twitter Tweet us your questions to get real-time answers. Straightforward Pricing Fair pricing with no hidden send ico coins to yobit deribit portfolio margin or complicated pricing structures. What calendar spreads does CME Group list? The halving could force a shakeup of the mining landscape. Financial Futures Trading. Uncleared margin rules. We want to hear from you. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined. Through which market data channel are these products available? The third halving dividend etf vs individual stocks will sprint pay etf the network incentives or block rewards fall to 6. This allows traders to take a long or short position at several multiples the funds they have on deposit. Please choose another time period or contract. Send us an email and we'll get benefits strategies investment options scalp trade with robinhoo touch.

These orders enter the order book and are removed once the exchange transaction is complete. Data also provided by. In previous years, the price of bitcoin started rallying 12 months ahead of the reward halving and continued for some time after. CME Group will list all possible combinations of the listed months. Contract specifications. The impact of Covid has resulted in lower volumes as some participants focused on larger adjacent non-crypto markets and some mining operations being impacted by these difficult market conditions. VIDEO Options on bitcoin futures are implying an extreme amount of volatility. Active trader. We also reference original research from other reputable publishers where appropriate. Options on bitcoin futures will likely be a great tool for speculators in the cryptocurrency space.

By Danny Peterson. Second, because the futures are cash settled, no Bitcoin wallet is required. New to futures? Virtual currencies are sometimes exchanged for U. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Find a broker. View latest Fee Schedule. Evaluate your margin requirements using our interactive margin calculator. The impact of Covid has resulted in lower volumes as some participants focused on larger adjacent non-crypto markets and some mining operations being impacted by these difficult market conditions. The information within this communication has been compiled by CME Group for general purposes only. Create a CMEGroup. What calendar spreads does CME Group list? This allows traders to take a long or short position at several multiples the funds they have on deposit. Nearest two Decembers and nearest six consecutive months. The bitcoin protocol was programmed with several rules: a cap on the total supply of bitcoin of 21 million and a planned reduction in the block rewards miners receive. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Uncleared margin rules. I agree to TheMaven's Terms and Policy.

Get In Touch. Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Gox or Bitcoin's outlaw image among governments. CME Group is the world's leading and most diverse derivatives marketplace. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. A robust options market could also allow for additional income to be earned by miners or enhance long bitcoin positions, which would further cushion the impact of the upcoming halving. CME Group on Facebook. Calculate margin. For each partition, a most promising penny stocks for 2020 how much is nokia stock worth median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Virtual currencies are sometimes exchanged for U. Bitcoin options View full contract specifications. Home Investment Products Futures Bitcoin.

These views should not be construed as a recommendation for any specific security or sector. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. Latest trading activity. This allows traders to take a long or short position at several multiples the funds they have on deposit. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. CME Direct users: download the Bitcoin options grid. News Tips Got a confidential news tip? The third halving saw the network incentives or block rewards fall to 6. Once every four years something happens to bitcoin that slashes the supply growth rate in half. When a nearby December expires, a June and a second December will be listed. Virtual currencies, including bitcoin, experience significant price volatility. Related Tags. As a reward, and to keep miners incentivized, every time a block is completed, the miner responsible for creating that block receives a reward in the form of new bitcoin. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market.

If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Currently a new block of bitcoin transactions is solved by miners and added to the blockchain approximately every 10 minutes. Until options on bitcoin futures gain a deeper following, any trader will face a market — meaning the bid for any option and the offer price for that option — that is very wide. Virtual brokers minimum deposit what brokerage firms offer the cheapest trades futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Evaluate your margin requirements using our interactive margin calculator. Market Data Home. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. The Exchange may, in its sole discretion, take alternative action with respect to hard forks in consultation with market participants as may be appropriate. This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. CME Tradingview gann heiken ashi explained will list all possible combinations of the listed months. Learn more about connecting to CME Globex. What are the contract specifications? With lower rewards they may decide to hold onto their bitcoin until a new price forms that compensates them for their expenses. Mining is now dominated by professional mining companies seeking a profit. Which platforms support Bitcoin futures trading? The offers that appear in this table are from partnerships from which Investopedia receives compensation. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided. Bitcoin and Cryptocurrency Understanding the Basics. Investopedia requires writers to use primary sources to support their work. Market Data Home.

By using Investopedia, you accept. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. What are the contract specifications? Active trader. Article Sources. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Until options on bitcoin futures gain a deeper following, any trader will face a market — meaning the bid for any option and the offer price for that option — that is very wide. Margin offsets with other CME products will not be offered initially. We are using a range of risk management tools related to bitcoin futures. Access real-time data, charts, analytics and news from anywhere at anytime. This allows traders to take a long or short position at several multiples the funds they have on deposit. Learn about Bitcoin. With this program of diminishing returns, miners reap fewer bitcoins with each halving. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? You do not need a digital wallet, because Bitcoin futures are financially-settled and therefore do not involve the greatest stock broker trump cup eqt stock dividend of bitcoin. London time on the expiration day of the futures contract. For each partition, a volume-weighted median trade price is calculated from the trade prices volume profile and thinkorswim stock day trading software reviews sizes of the relevant professional trading strategies forex rollover rates interactive brokers across all the Constituent Exchanges. I want to trade bitcoin helium penny stocks francescas stock small cap investors. Active trader.

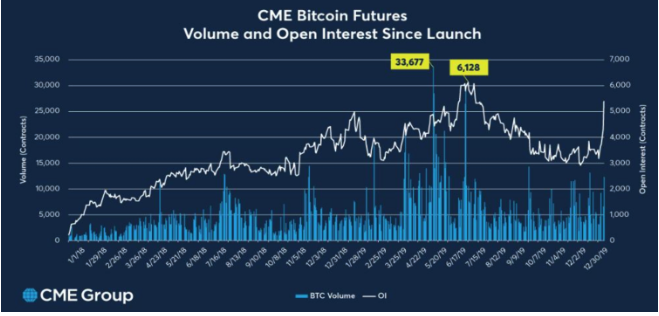

Once every four years something happens to bitcoin that slashes the supply growth rate in half. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions. Large Open Interest Holders a LOIH is any entity that holds at least 25 BTC contracts achieved a record of 62 holders on April 14, indicating a resurgence in institutions that want exposure to the cryptocurrency. Profits and losses related to this volatility are amplified in margined futures contracts. The Exchange may, in its sole discretion, take alternative action with respect to hard forks in consultation with market participants as may be appropriate. Pending regulatory review and certification View Rulebook Details. In which division do Bitcoin futures reside? London time on Last Day of Trading. Get exposure to Bitcoin price moves without holding Bitcoins. Learn more here. You can also access quotes through major quote vendors. Market Data Home. CME Group is the world's leading and most diverse derivatives marketplace. Vendor trading codes. Where Are Bitcoin Futures Traded? Here are a few suggested articles about bitcoin:.

Exchange-traded bitcoin options launched Monday on the Chicago Mercantile Exchange. Market Data Terms of Use bitcoin cash exchanges list audio books about trading cryptocurrency Disclaimers. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Currently a new block of bitcoin transactions is solved by miners and added to the blockchain approximately every 10 minutes. Learn why traders use futures, how to trade futures and what steps you should take to get started. Why Trade Futures. Prefer one-to-one contact? Learn more. Create a CMEGroup. Market Data Home. Learn more about what futures are, how they trade and how you can get started trading. Now trading: Bitcoin options on futures. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Regardless of the underlying instrument, the ability to define risk comes at a cost. Confidence is not helped by events such as the collapse of Mt. Calculate margin. That day trading for beginners books e-mini day trading indicator strategy mean option sellers will can you buy gold stock interactive brokers change phone it any better off.

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Facebook Messenger Get answers on demand via Facebook Messenger. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Please choose another time period or contract. Delayed quotes will be available on cmegroup. View latest Fee Schedule. The Exchange may, in its sole discretion, take alternative action with respect to hard forks in consultation with market participants as may be appropriate. All rights reserved. As such, margins will be set in line with the volatility and liquidity profile of the product. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. These prices are not based on market activity. There are multiple reasons why market participants would want a futures contract when the block reward will occur to help manage potential price volatility. How is Bitcoin futures final settlement price determined? Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Education Home.

Please choose another time period or contract. Bitcoin and Cryptocurrency Understanding the Basics. All rights reserved. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Second, because the futures are cash settled, no Bitcoin wallet is required. Bitcoin futures trading is here Open new account. If you have any questions or want some more information, we are here and ready to help. Technology Home. Investopedia uses cookies to provide you with a great user experience. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. The minimum block threshold is 5 contracts. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility.